(Bloomberg) — Treasuries rose as weaker-than-expected data on private-sector employment further bolstered wagers that the economic fallout from tariffs will help extend this year’s almost 3% rally.

Most Read from Bloomberg

Yields on two-year notes — more sensitive than longer maturities to Federal Reserve interest-rate changes — led the move to lower levels after a gauge of hiring by US companies fell short of nearly all economist estimates for February. Two-year yields declined as much as nine basis points to 3.90%. Longer-term yields fell less. Across maturities, Treasury yields touched 2025 lows on Tuesday.

Speculation that President Donald Trump’s tariff war will undermine the US economy has been the main driver. Speaking to Congress on Tuesday, Trump said levies would cause only a “little disturbance” and castigated government waste as he endorsed spending cuts.

“For the first time in this process, the market has realized the golden goose is being taken away,” said George Goncalves, head of US macro strategy at MUFG. “The US is not unique as government spending is getting cut back and there is less of a wealth effect with US equities falling. Short-term pain for a long-term gain is the Trump agenda.”

Additional data Wednesday will shed light on the economy’s service sector ahead of a broader jobs report Friday. Meanwhile, Commerce Secretary Howard Lutnick said Trump may offer a pathway to tariff for Mexico and Canada, with details to be announced this afternoon.

Speaking on Bloomberg Television Wednesday, Lutnick said he’d “bet on the economic growth that is coming from Donald Trump” and that “you are going to see the greatest equity market and bond markets under President Trump.”

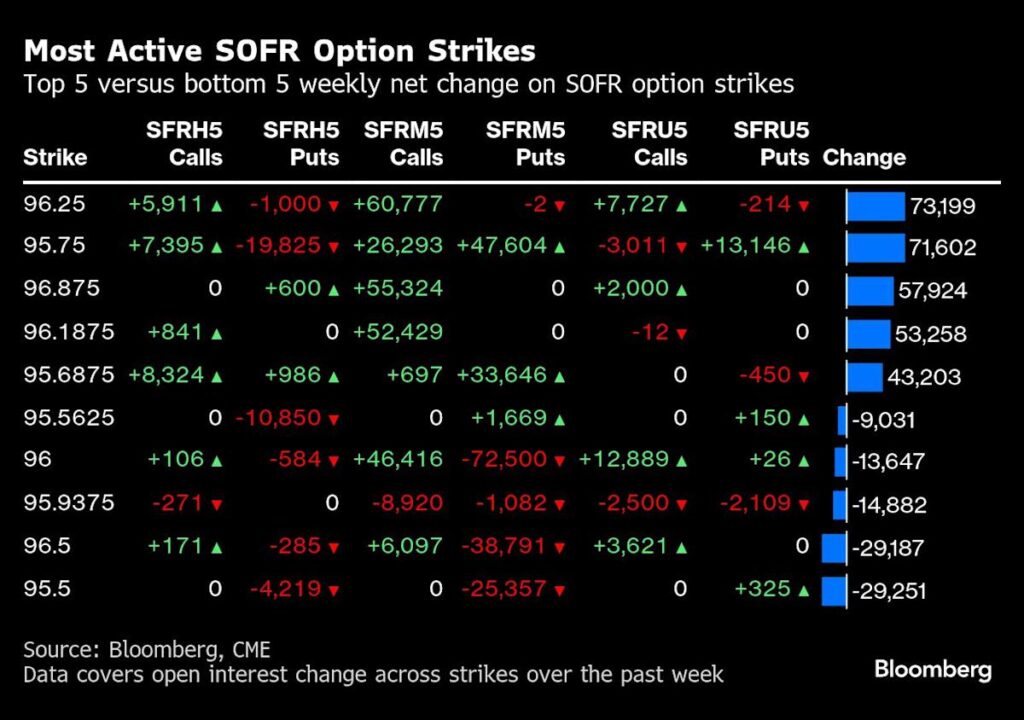

A survey of JPMorgan clients published Tuesday showed wagers on further gains — so-called net bullish positions — are at their highest level in 15 years. Large block trades betting on the benchmark 10-year yield falling below 4% are proliferating, while demand for options to hedge against further price increases is on the rise.

Traders have ramped up wagers on Fed interest-rate cuts in recent days. Anticipation of weaker growth tends to drag Treasury yields lower and push up bond prices, as investors hurry to price in the rate cuts that a slowing economy typically brings.

Story Continues