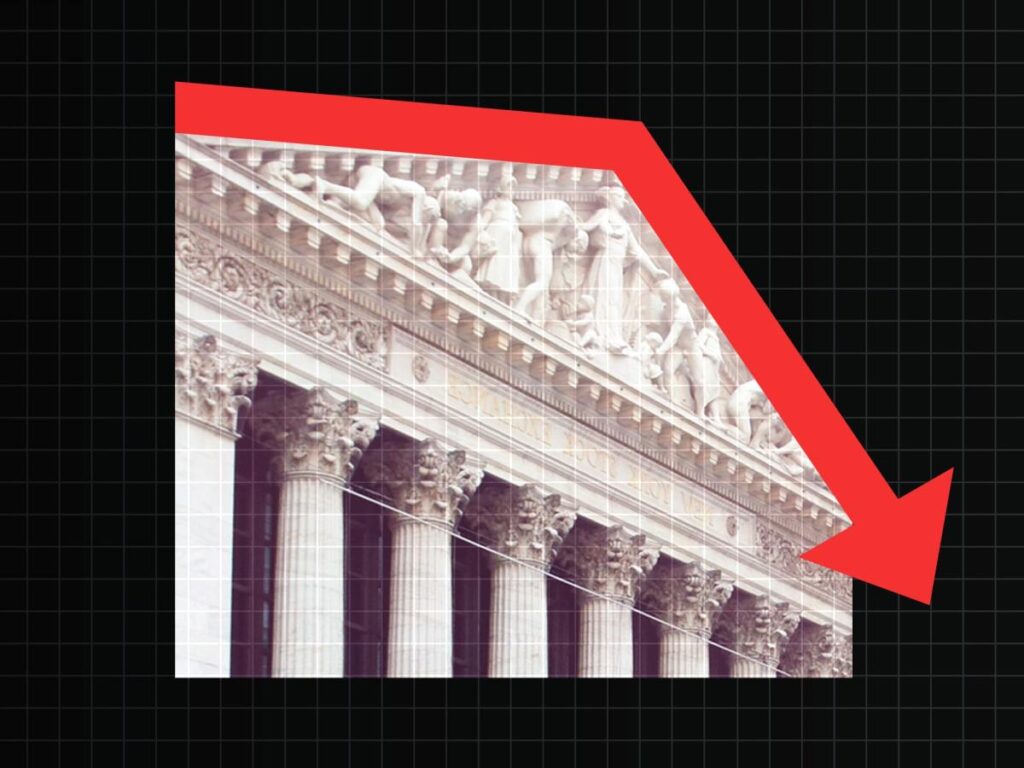

Top economists are eyeing the rising risk that the US will be hit with a bout of stagflation.

It’s a painful scenario that entails higher inflation and slower economic growth.

Kansas City Fed president Jeff Schmid this week highlighted the risk of that combined scenario.

Fears of a dire economic scenario have crept into the discussion recently, with top commentators this week expressing concern the US could be headed for a period of stagflation.

Such a scenario entails high inflation and low economic growth, two things that don’t normally go hand in hand. Stagflation slammed the US during the 1970s and economists say it can be even trickier for policymakers to resolve than a recession.

While central bankers would typically cut interest rates in response to slowing economic growth, high inflation would make the Fed hesitant to loosen financial conditions any further, leaving their hands tied in both directions.

Jeff Schmid, the Kansas City Fed president, has suggested such a scenario is already on his radar.

«While the risks to inflation appear to be to on the upside, discussions with contacts in my district, as well as some recent data, suggest that elevated uncertainty might weigh on growth,» Schmid said at an event in Virginia on Thursday.

«This presents the possibility that the Fed could have to balance inflation risks against growth concerns.»

Meanwhile, that same day, Torsten Sløk — the chief economist of Apollo Global Management — told Bloomberg TV he believes the ingredients for stagflation may already be present. He pointed to more fragmented global trade, increased immigration around the world, and industrial policies from other countries that have limited competition, all of which could raise prices.

«On a number of different fronts, you can both have, at the same time, higher inflation and weaker growth, which is the definition of stagflation,» he said on Thursday. «It’s a stagflationary shock when you see inflation going up and growth slowing down. And that just happens to be the backdrop for the conversation that we’re having in markets at the moment.»

Inflation has shown signs of re-accelerating in recent months after a period of cooling off from multi-decade highs. Consumer prices rose 3% year-over-year in January, above December’s 2.9% inflation rate.

Personal consumption expenditures inflation, the Fed’s preferred inflation measure, eased slightly to 2.5% in January but remained well above the central bank’s 2% target.

Economic growth, meanwhile, appears to have slowed in recent years. GDP is expected to grow 2.3% this quarter, according to the Atlanta Fed’s latest GDPNow reading, down from a peak of 4.4% in the third quarter of 2023.

Story Continues