Marketing budgets were revised upward in Q2, but the growth was largely driven by tactical activities, such as sales promotions and direct marketing, suggesting marketers are under pressure to drive short-term, measurable results.

Marketing budgets were revised upward in Q2, but the growth was largely driven by tactical activities, such as sales promotions and direct marketing, suggesting marketers are under pressure to drive short-term, measurable results.

After marketing budgets contracted for the first time in four years in Q1, the latest IPA Bellwether report, published today (17 July), reveals an uptick in advertising spend.

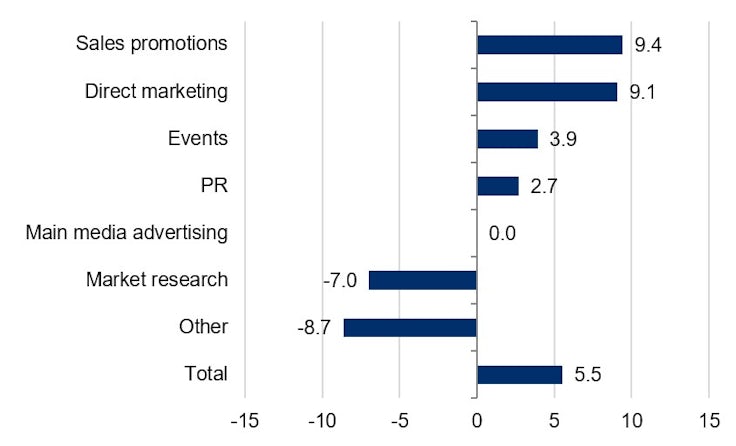

A net balance of 5.5% of panellists reported an increase in overall marketing budgets, a turnaround from the -4.8% recorded in Q1, which marked the first decline in four years.

However, a breakdown of spending plans reveals that marketers raised their spending primarily for sales promotions and direct marketing, with net balances rising from 8.0% to 9.4% and 9.0% to 9.1% respectively.

Marketing budgets were revised upward in Q2, but the growth was largely driven by tactical activities, such as sales promotions and direct marketing, suggesting marketers are under pressure to drive short-term, measurable results.

Marketing budgets were revised upward in Q2, but the growth was largely driven by tactical activities, such as sales promotions and direct marketing, suggesting marketers are under pressure to drive short-term, measurable results.

After marketing budgets contracted for the first time in four years in Q1, the latest IPA Bellwether report, published today (17 July), reveals an uptick in advertising spend.

A net balance of 5.5% of panellists reported an increase in overall marketing budgets, a turnaround from the -4.8% recorded in Q1, which marked the first decline in four years.

However, a breakdown of spending plans reveals that marketers raised their spending primarily for sales promotions and direct marketing, with net balances rising from 8.0% to 9.4% and 9.0% to 9.1% respectively.Marketing budgets ‘under increased scrutiny’ amid global uncertainty

IPA’s director general Paul Bainsfair notes that while agility is “crucial” in today’s fast-paced market, short-term activation efforts must be “balanced” with investment in long-term, emotionally-driven brand building strategies.

“By striking this balance, companies can position themselves not only for immediate success, but also for enduring growth in an increasingly competitive landscape,” he says.

While short-term channels led the growth, the overall increase in advertising spend was historically strong – the highest since Q2 2024. The data shows 22.7% of panellists increased their budgets, compared to 17.2% who made cuts.

Channel breakdown

Budgets for events and public relations also increased, though at a slower rate than in Q1. Events dropped from a net balance of 5.4% to 3.9%, and PR declined from 3.4% to 2.7%.

Meanwhile, main media budgets, often considered essential for brand building, remained flat, following two quarters of decline. The net balance held steady at 0.0%, following a -6.7% reading in Q1.

However, within main media advertising, individual brand-building channels like out-of-home (OOH), audio, and published brands continued to contract. Once again, OOH experienced the steepest decline in marketing spend, although the rate of reduction eased. A net balance of -8.9% was recorded, compared to -18.9% in Q1, with 20.0% of panellists cutting spend and just 11.1% reporting an increase.

Similarly, audio and published brands remained in negative territory, with net balances of -6.3% and -4.8% respectively. Both categories improved slightly from Q1, which posted -10.8% and -8.3%.

Video was one of only two main media subcategories to avoid contraction, with budgets holding steady following a net balance of -1.0% in Q1. Meanwhile, ‘other online’ advertising was the only category to record growth, with its net balance rising from 0.7% to 2.2%.

Outside of main media budgets, market research and the ‘other’ category were the only tracked areas to see budget cuts. However, the net declines of -7.0% for market research and -8.7% for other were less severe than Q1’s -10.5% and -11.7%.

Budget outlook and company confidence

Despite ongoing challenges, there are signs of optimism. Some companies are turning to automation and AI to improve efficiency and cut costs, with others strengthening in-person client services to stand out amid growing AI competition, respondents noted.

However, risks remain. Recruitment continues to pose a challenge, exacerbated by rising costs following national insurance changes introduced in April.

Economic uncertainty and low consumer confidence are also impacting business sentiment, as panellists contend with reduced client purchasing power. Increased trade barriers, including new tariffs and wider geopolitical tensions, are further dampening the outlook.Marketers adopt ‘wait and see’ approach as budgets fall for first time in four years

Despite facing several headwinds in H1 2025, the UK economy is still expected to grow, suggesting a degree of resilience. GDP is projected to grow by 0.8% this year, slightly higher than the 0.6% forecasted in the previous quarter.

However, inflation is expected to remain above the central bank’s 2% target, most recently rising to 3.6%, which could place further pressure on growth. Tariff changes from the US and ongoing tensions in the Middle East are also expected to weigh on business and household confidence.

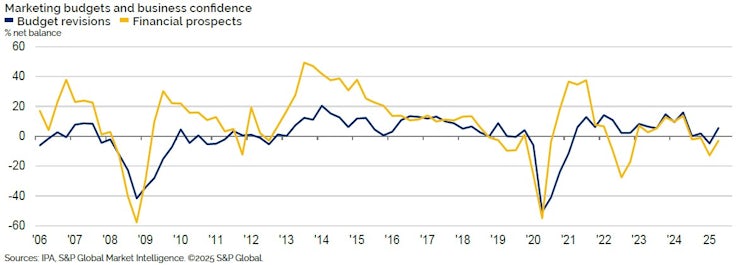

That said, marketers reported a modest improvement in sentiment at both company and industry level, following a period of deep pessimism in Q1.

Reduced pessimism regarding financial prospects suggests that businesses are becoming “more acclimatised to current market conditions”, according to S&P Global Market Intelligence economist, Maryam Baluch.

At the company level, 21.9% of panellists said they were more optimistic than three months ago, while 24.9% were less confident. Although the net balance remained negative for the fourth consecutive quarter, it improved from -12.9% in Q1 to -3.0% in Q2.

However, broader industry sentiment remains subdued. The net balance for industry-level financial prospects rose slightly from -37.4% to -26.2%, continuing a long-running trend of negativity dating back to Q4 2021. Specifically, 36.9% of firms were less upbeat towards financial prospects than they were three months ago, overshadowing the mere 10.7% that were more positive.