(Bloomberg) — Little is going right at Porsche AG: Sales are slumping, earnings are in decline, top executives are being ousted.

Most Read from Bloomberg

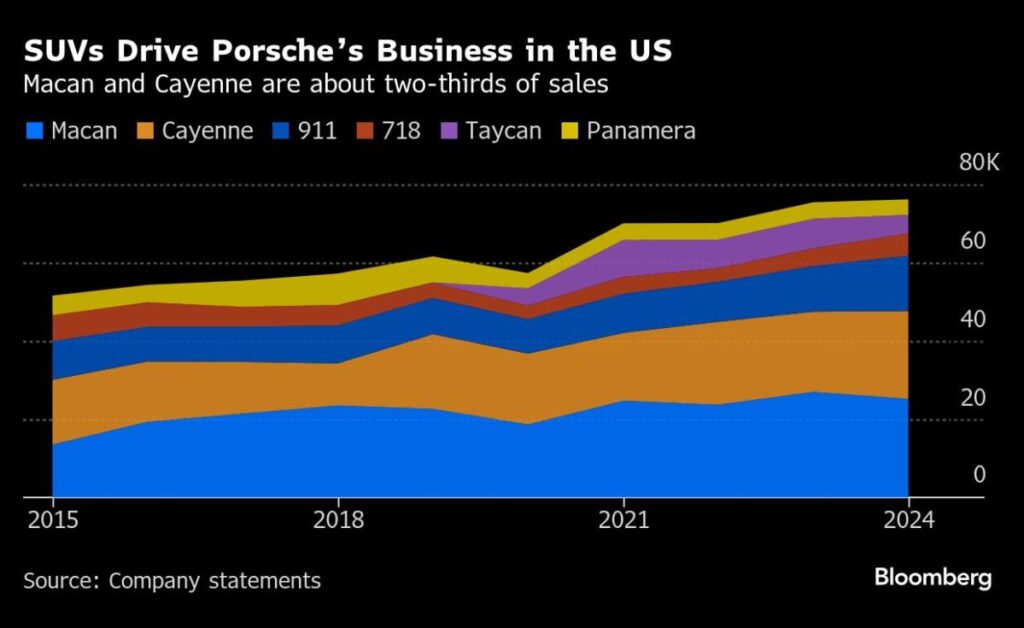

And in a market where buyers are still snapping up 911 sports cars and Cayenne sport utility vehicles, the president is saying new tariffs “definitely” are coming.

Porsche is especially vulnerable to the threats Donald Trump is again lobbing at the European Union. The German manufacturer has steadily grown the last 15 years in the US, which just overtook China as its No. 1 market in the world. But Porsche’s US dealers are entirely reliant on imports.

“If the tariff implemented is significantly above 10%, then they would have to consider moving some SUV production to the US,” Bloomberg Intelligence analyst Michael Dean said. Porsche and Mercedes-Benz Group AG would lose out most if Trump hikes levies on EU autos, he wrote in a Feb. 4 report.

There’s no quick fix to get the company out of this predicament. It can’t easily leverage its parent Volkswagen AG’s lone American plant, in Tennessee, because no Porsche model shares underpinnings with the VW Atlas or ID.4 SUVs manufactured there.

Chief Executive Officer Oliver Blume can ill afford the major investment that moving production around would require. Porsche is falling further off track from targets floated when the company staged one of Europe’s biggest-ever initial public offerings in 2022. Its return on sales will slump to as low as 10% this year, half of what management once touted as a long-term target.

That downbeat outlook sent Porsche shares tumbling 7% on Friday to a new low since the IPO. At €50.8 billion ($52.4 billion), the company is now worth less than half its peak market value in May 2023.

Porsche said late Feb. 6 that it will take an €800 million hit this year tied to expanding its product portfolio with more combustion engine and plug-in hybrid models. The company’s first all-electric model, the Taycan, got off to a fast start following its 2020 debut, but sales stumbled last year. A new EV version of the Macan sport utility vehicle has underwhelmed since launching years behind schedule.

While disappointing demand for Porsche EVs has dogged the company in China, where deliveries fell 28% last year, this is less of an issue in the US. Plug-in car adoption has been slower across the industry, and American consumers have bought more Porsches in all years but one since 2009. (Its lone down year was 2020, when the Covid-19 pandemic began.)

Story Continues