(Bloomberg) — The Philippine economy grew slower than expected in the fourth quarter and for the full year, dragged by sluggish investment, consumption and farm output that may spark more monetary policy easing.

Most Read from Bloomberg

Gross domestic product in October to December rose 5.2% from a year earlier, the statistics agency said on Thursday. That’s below the 5.5% median estimate in a Bloomberg News survey and matches the 5.2% pace in July to September.

Full-year growth at 5.6% missed the adjusted government target of 6% to 6.5% and also the 5.8% forecast by economists. On quarter, the expansion was slower than estimated at 1.8%.

A particularly devastating typhoon season in the second half damaged crops and dragged down farm output while global uncertainties and geopolitical tensions hurt manufacturing, according to Philippine officials. Household consumption, which accounts for about two-thirds of the economy, grew slower.

The Philippines seeks to regain momentum this year to bring growth to at least 6% while prioritizing price stability, Undersecretary Rosemarie Edillon of the economic planning agency said at a briefing.

Finance Secretary Ralph Recto said the government remains “optimistic” about its outlook for 2025. “A lower inflation rate gives us more room to ease interest rates, which will further boost consumption,” he said in a statement. Recto sits in the central bank’s policymaking Monetary Board.

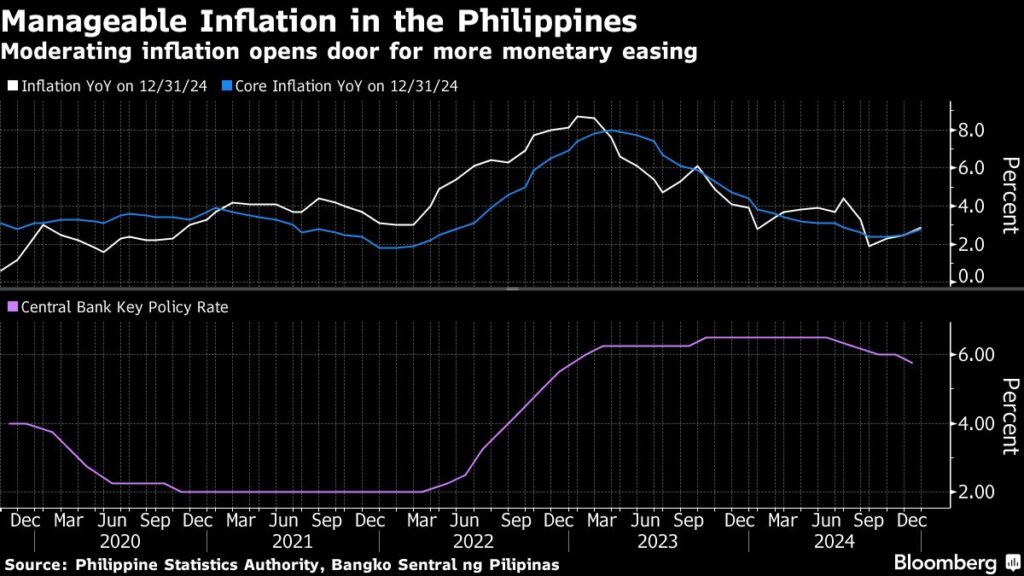

Inflation in the Philippines averaged 3.2% last year, well within the 2%-4% target, although policymakers have become more cautious in the face of rising tariff risks and evolving US policies under Donald Trump.

In 2024, the Bangko Sentral ng Pilipinas took advantage of cooling inflation to deliver 75 basis points in interest rate cuts starting August, bringing borrowing cost to a two-year low. The BSP will review the key rate on Feb. 13.

Governor Eli Remolona earlier this month said that the Philippines still has “some room to ease” as borrowing cost at 5.75% is still in restrictive territory.

“Lower-than-expected GDP growth suggests BSP could consider cutting rates further to support growth momentum with inflation forecast to stay within target,” said Nicholas Mapa, an economist at Metropolitan Bank & Trust Co. in Manila.

Story Continues