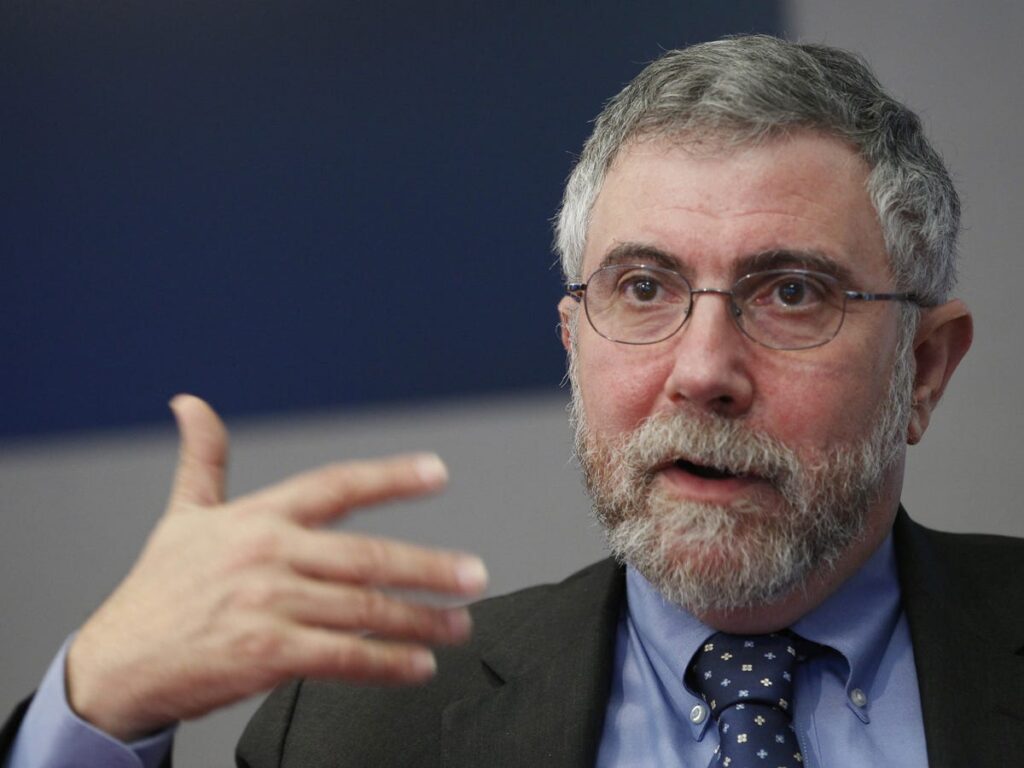

Paul Krugman says the AI boom is like the dot-com bubble but might not end with a massive crash.

The Nobel-winning economist said tech stars are already dominant and more involved in politics now.

Krugman said the frenzy might finish with a «giant tech-bro bailout.»

Paul Krugman says the AI frenzy has shades of internet mania — but might not finish with a devastating crash.

Krugman, a winner of the Nobel Memorial Prize in Economic Sciences, said in a Substack post this week that the heady valuations of some technology stocks and the mass excitement about the future reminded him of the internet craze.

Even so, he wrote that «while AI fever bears a lot of resemblance to the dot-com bubble, the end game may be quite different.»

The former MIT and Princeton professor highlighted two key differences. One is that in his view, dot-com exuberance partly reflected investors’ hopes that startups would become «highly profitable quasi-monopolies» that benefited from huge network effects, like Microsoft. Yet the stars of the AI revolution are the Magnificent Seven, a group that largely fits that bill already.

«I don’t know whether people realize how anomalous this is,» Krugman said. «Historically, major new technologies have tended to disrupt the existing market hierarchy; this time, investors are in effect expecting radical new technology to reinforce that hierarchy.»

Krugman, who resigned as a New York Times columnist in December after nearly 25 years, questioned whether AI would make the incumbent tech titans more profitable when they’re already so dominant.

He said they might even generate less income if they have to pour money into AI to defend their positions, especially if they’re overspending.

The other big difference is that Silicon Valley was largely divorced from politics a quarter-century ago, Krugman said, whereas now Big Tech bosses like Jeff Bezos and Mark Zuckerberg have close ties to the government.

Krugman said that Tesla stock — which has surged more than 12-fold since the start of 2020, valuing the company at $1.2 trillion or north of 12 times its annual revenues — «makes sense, if at all, only in terms of Elon Musk’s apparent role as co-president.»

The veteran economist said those differences could lead to a different outcome from this tech bonanza. He pointed to President Donald Trump’s proposals to build a strategic cryptocurrency reserve and support a $500 billion private-sector investment in AI infrastructure. He said both programs could channel money into tech as investors sell their coins to the government and AI companies benefit from federal support.

Story Continues