(Bloomberg) — Columbus, Ohio, is having a moment. But, as more businesses and residents flock to the state capital for its cheaper cost of living, its aging airports are feeling the strain.

Most Read from Bloomberg

To address the region’s growing capacity needs the region’s airport authority will issue $1 billion of investment-grade municipal debt on Tuesday, marking the agency’s largest bond sale ever and the most ambitious overhaul in the history of Columbus’ airports. Proceeds will go toward building a modern facility replacing the outdated 1958 terminal for the John Glenn Columbus International Airport, as well as retiring debt and a reserve account, according to preliminary bond documents.

“As external businesses grow and more and more folks move to the area, we need an airport that can support the future needs of the community,” said Fabio Spino, chief financial officer of the Columbus Regional Airport Authority.

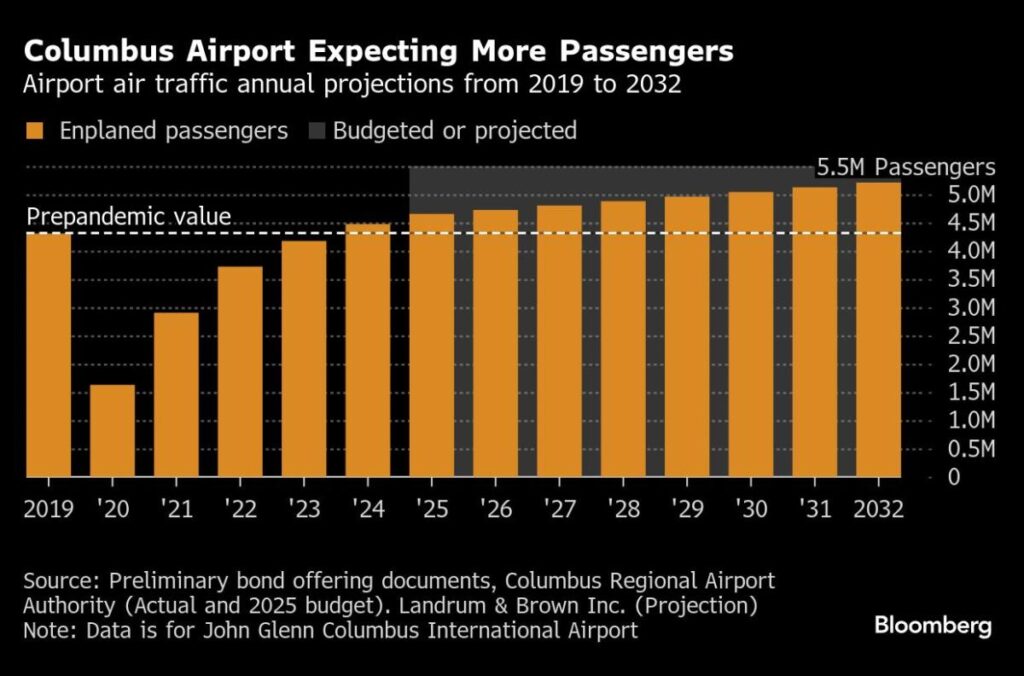

The region has become a magnet for travelers, driven by its rapidly growing population and an economy bolstered by major employers like Nationwide Mutual Insurance, Honda Motor Co. and JPMorgan Chase & Co. The agency projects the John Glenn airport will reach five million passengers over the next five years.

The airport, which currently offers mainly domestic travel, is working to expand international offerings as passenger demand grows. The influx of business travelers — who tend to spend more on airfare, premium seating, parking and concessions — will be a cornerstone of the airport’s growth strategy.

“This facility is past its useful life,” said Joseph Nardone, chief executive officer of the authority. After a record number of travelers in 2024, he expects the agency will have logged its best financial year ever. “The program is about improving facilities for customers and continuing to spotlight Columbus as a boomtown.”

Columbus joins a stream of airports looking to issue debt in 2025, including facilities in San Francisco and Texas. Airports borrowed more than $20 billion from muni investors last year, according to data compiled by Bloomberg.

The new terminal in Columbus will streamline the airport’s layout by consolidating its three existing concourses into a single, unified area. The project will expand the number of gates to boost passenger capacity. Key features will include a centralized security checkpoint, a marketplace offering new retail and dining options, as well as an almost 5,300 space parking garage connecting to the terminal by a pedestrian bridge.

Story Continues