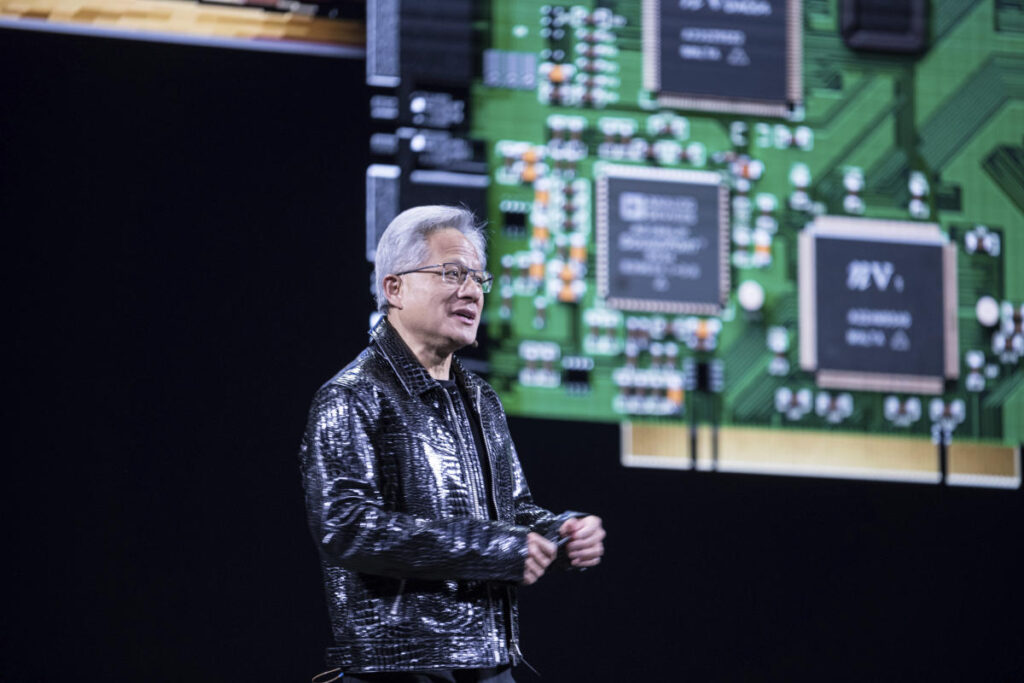

Nvidia (NVDA) stock rose as much as 2.6% premarket Tuesday as the AI chipmaker began to recover from a massive decline the prior day that shaved nearly $600 billion off its market cap.

Shares of the chipmaker later pared gains, up less than a percentage point after the market open.

Nvidia’s 17% freefall Monday was prompted by investor anxieties related to a new, cost-effective AI model from the Chinese startup DeepSeek. Some Wall Street analysts worried that the cheaper costs DeepSeek claimed to have spent training its latest AI models, due in part to using fewer AI chips, meant US firms were overspending on artificial intelligence infrastructure. That created a concern among the investment community that Nvidia’s high GPU (graphics processing unit, or AI chip) prices could come under pressure and that demand for semiconductors could wane.

Nvidia’s $589 billion market cap decline was the largest single-day loss in stock market history.

The DeepSeek announcements drove down not only Nvidia but the market at large, with the tech-heavy Nasdaq dropping 3%. Chip stocks dropped across the board Monday, but some names began to recover Tuesday morning. After dropping more than 17% to start the week, Broadcom (AVGO) rose as much as 3% premarket Tuesday and was up half a percentage point after the market open.

Nvidia itself didn’t express much anxiety over the DeepSeek buzz, calling R1 «an excellent AI advancement» in a statement Monday.

Wall Street analysts continued to reflect on the DeepSeek-fueled market rout Tuesday, expressing skepticism over DeepSeek’s reportedly low costs to train its AI models and the implications for AI stocks.

JPMorgan (JPM) analyst Harlan Sur and Citi (C) analyst Christopher Danley said in separate notes to investors that because DeepSeek used a process called “distillation” — in other words, it relied on Meta’s open source AI model Llama to develop its model — the low spending cited by the Chinese startup (under $6 billion to train its recent V3 model) did not fully encompass its costs.

“We believe it is crucial to validate these costs before drawing conclusions,” wrote Sur.

Danley added: “Given Deepseek is based on leveraging cloud service providers [Meta] and AI is still in its infancy, we lean towards the argument of continued strong growth in AI spending.”

Even so, DeepSeek “clearly doesn’t have access to as much compute as US hyperscalers and somehow managed to develop a model that appears highly competitive,” Raymond James analyst Srini Pajjuri wrote in a note to investors Monday.

Story Continues