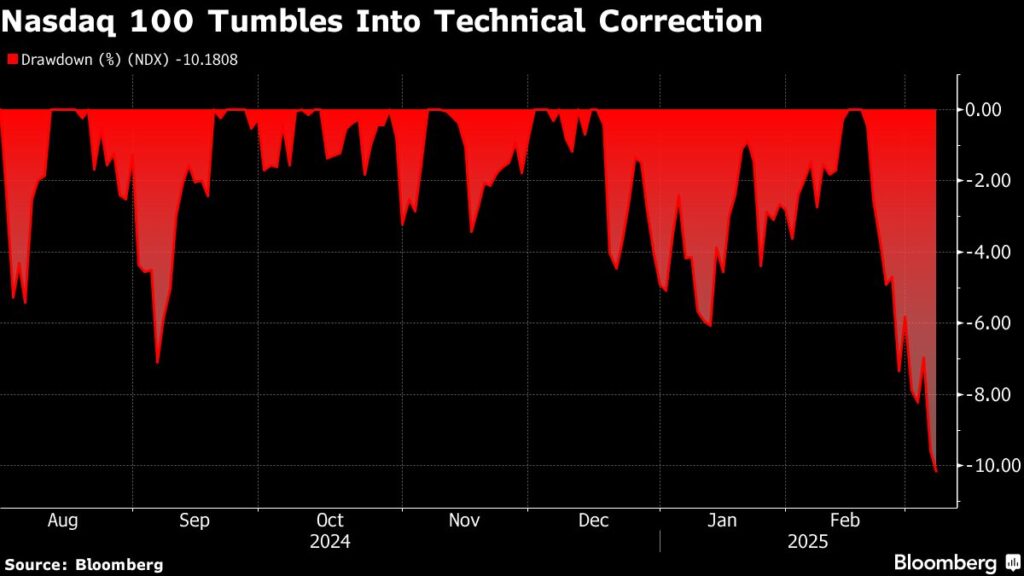

(Bloomberg) — The Nasdaq 100 Index (^NDX) sank into a correction on Friday, as investors continue to sour on the megacap technology stocks that led the stock market rally over the past two years.

Most Read from Bloomberg

The index was down 0.8% at 10:37 a.m. in New York and is now 10.2% below a peak hit just last month, putting it past the 10% threshold that represents a market correction. Among notable decliners, Nvidia Corp. (NVDA) slid 0.7%, Amazon.com Inc. (AMZN) fell 1.5%, and Microsoft Corp. (MSFT) 1.9%. The Bloomberg Magnificent 7 Total Return Index, which entered a correction of its own in late February, 1.1% on Friday.

Much of the slump reflects Wall Street’s rapid rotation out of companies tied to artificial intelligence. Since the Nasdaq 100 hit a record high on Feb. 19, Nvidia has lost more than a fifth of its value and is responsible for 18% of the index’s overall decline, according to data compiled by Bloomberg that goes through Thursday’s close. Other notable decliners since that peak include Tesla Inc. (TSLA), Apple Inc. (AAPL), Palantir Technologies Inc. (PLTR), Meta Platforms Inc. (META) and Amazon.com.

“Over the past few years, the Magnificent Seven have done exceptionally well, and they deserved the premium they were trading at because of how well they were growing their top and bottom lines,” said George Cipolloni, a portfolio manager at Penn Mutual Asset Management. “That has sort of changed. Earnings were pretty good for big tech this past quarter, but I’m not sure they’ll get much better from here, and there’s only so much a company can grow at these multiples.”

While investors remain broadly optimistic about the long-term potential of AI, this earnings season failed to show the kind of growth or profitability many investors had hoped for. That has raised further questions about big tech’s strategy of pouring tens of billions of dollars into AI-related expenditures with little to show so far.

In addition, there’s new scrutiny on the group’s sky-high equity multiples, which reflected stronger growth trends than are now expected. And AI developments out of China — with companies claiming strong performance with less cost and fewer high-powered chips — are further clouding the outlook.

With the Nasdaq 100 more than doubling from the start of 2023 to its latest all-time high, it was a natural place for investors to take profits. But more broadly, a cloudy backdrop — marked by a weakening US economy, trade wars and rising geopolitical tensions — is creating a general risk-off mood in the stock market. The S&P 500 Index (^GSPC) is down 7.2% from its peak, which also came on Feb. 19.