(Bloomberg) — Meta Platforms Inc. shares are on track for their longest streak of daily gains in almost a decade, with its latest earnings report adding to investor confidence about its strategy with artificial intelligence.

Most Read from Bloomberg

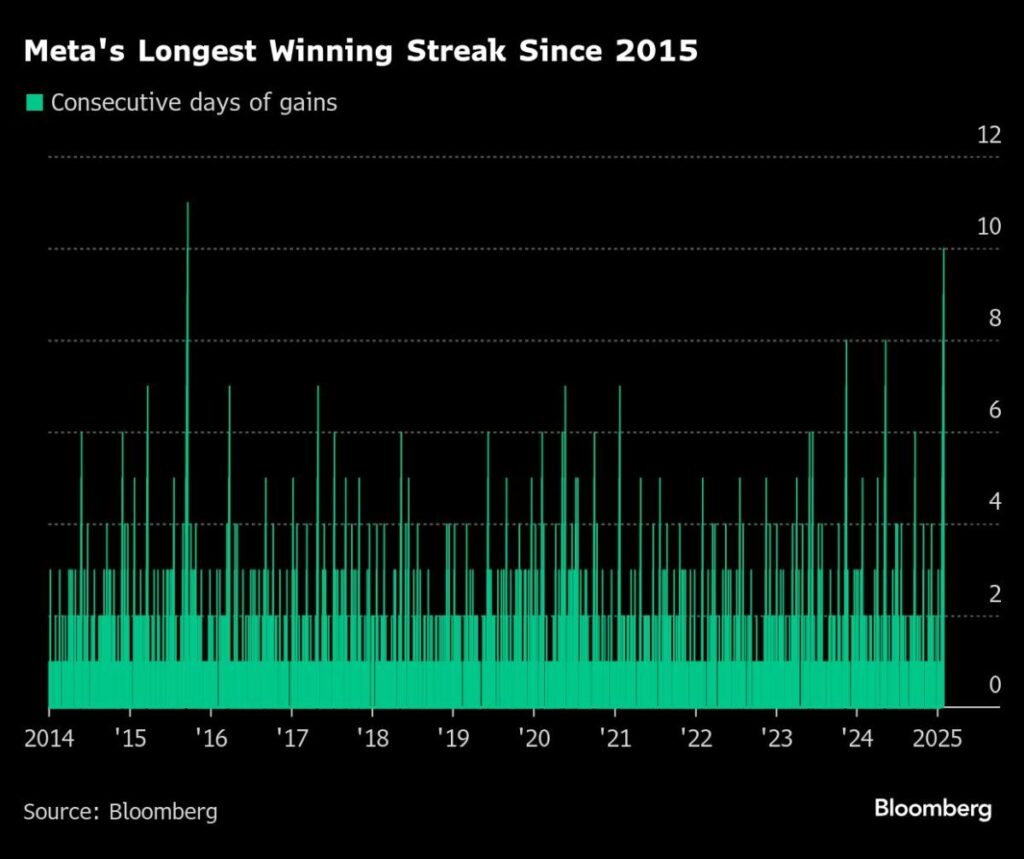

The stock rose 2.6% on Friday, up for a 10th straight session in the longest rally since an 11-day run that ended in September 2015. The Facebook parent has gained as much as 16% over the streak, hitting a series of records, and January’s 20% climb is set to be Meta’s best month since February.

AI has been a central focus, with investors betting Meta will be a main beneficiary as the technology grows more mainstream. The company uses AI to improve ad targeting and boost user engagement.

“Meta has shown a lot of great execution, and there’s a lot of optimism about how much AI can help the company,” said Robert Pavlik, senior portfolio manager at Dakota Wealth Management. “The future of advertising continues to be in directly targeting specific audiences, and it can use AI to its advantage in doing that. I think there’s still more upside to shares.”

The advance in 2025 follows last year’s 65% rally, as well as a surge in 2023 where shares nearly tripled.

Earlier this week, Meta Chief Executive Officer Mark Zuckerberg predicted that 2025 would be a “really big year” for AI. Wall Street took that as validation of the company’s AI strategy, as well as the billions of dollars it is spending on AI infrastructure, offsetting a revenue forecast that was slightly disappointing relative to consensus expectations.

The comments came after a pre-earnings announcement that Meta would invest as much as $65 billion on AI-related projects in 2025. While AI spending has come under scrutiny of late, as investors look to see a more pronounced return on the investment, analysts took Meta’s target as a sign of confidence.

Meta’s strategy got additional validation earlier this week, with the emergence of China’s AI startup DeepSeek, which is an open-source AI model similar to Meta’s Llama.

Even with the recent strength, Meta trades at 26.6 times estimated earnings, essentially in line with the Nasdaq 100 Index.

“Based on recent trends, you could justify a 30 multiple on this stock,” said Pavlik, who added that shares could rise to $755 going forward, compared with their current price of about $700.

Story Continues