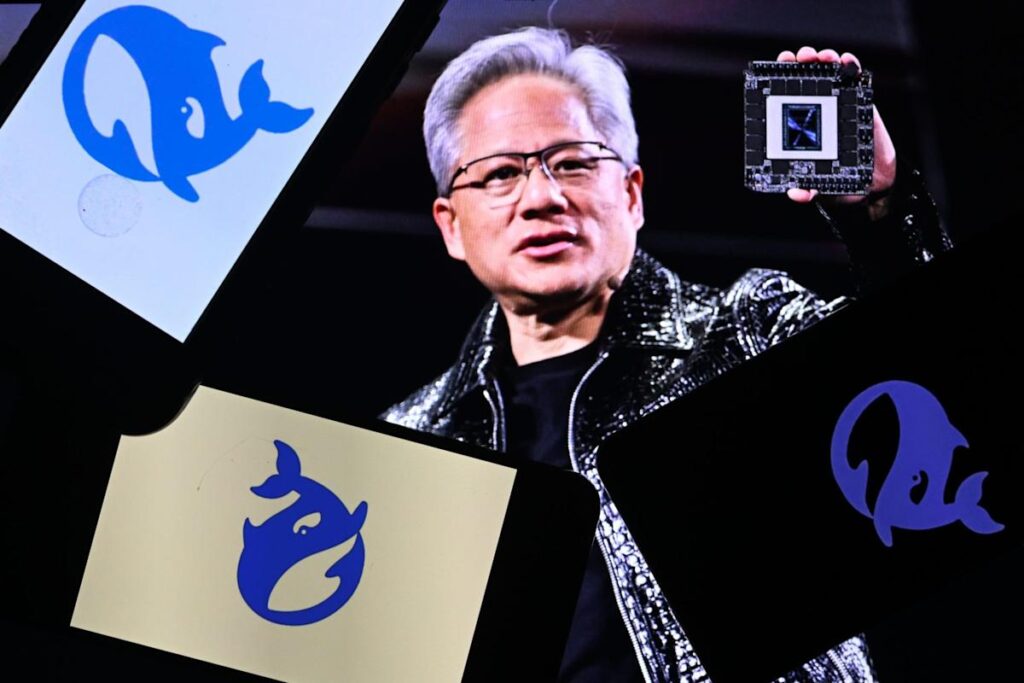

Nvidia CEO Jensen Huang touted «extraordinary» demand for the company’s next-generation Blackwell offering on the company’s earnings call Wednesday, brushing aside concerns that the surprise success of Chinese AI startup DeepSeek will lower demand for compute power. Instead, he suggested that customer appetite for cutting-edge chips is just scratching the surface.

The surprise success of Chinese AI startup DeepSeek has not appeared to weigh on Nvidia’s sales. After the company posted record revenues that beat Wall Street’s expectations yet again, CEO Jensen Huang told analysts why he believes investor fears about declining demand for compute power are misplaced.

«Going forward, data centers will dedicate most of CapEx to accelerated computing and AI,» Huang said. «Data centers will increasingly become AI factories, and every company will have them, either rented or self operated.»

Wednesday marked the company’s first earnings release since DeepSeek debuted a large language model that could match those of American competitors like OpenAI for a fraction of the cost, supposedly using reduced-capacity Nvidia chips. Huang’s company lost nearly $600 billion in market cap on the news, the largest single-day drop for any U.S. firm in history. The chipmaker’s major customers, however, don’t seem deterred, with Meta, Amazon, Google, and Microsoft set to invest as much as $320 billion in A.I. and data center buildout, per CNBC, based on comments from these companies’ CEOs on earnings calls earlier this year.

Echoing previous comments, Huang said demand for Nvidia’s next-generation Blackwell offering is “extraordinary.” The company said it sold $11 billion worth of the chips for the quarter.

“Customers are anxious and impatient to get their Blackwell systems,” Huang said.

Blackwell moves the needle by allowing customers to customize data center configurations to their needs, but the platform’s originally faced delays amid reports of server racks overhearing. At the time, Nvidia said those issues were “normal and expected,” but Huang acknowledged them on Wednesday’s call.

It proved difficult for the company to switch from focusing on the company’s Hopper chips, which initiated the AI boom, to Blackwell, he told analysts. Future updates, he said, will be easier to implement.

“This is the fastest product ramp in our company’s history, unprecedented in its speed and scale,” CFO Colette Kress said.

Huang waited until the end of the call to directly acknowledge DeepSeek’s R1 model, which he said had “ignited global enthusiasm.”

Story Continues