(Bloomberg) — Japan’s corporate bond market is booming, as an economic rebound and plans to get ahead of higher interest rates encourage a flurry of issuance.

Most Read from Bloomberg

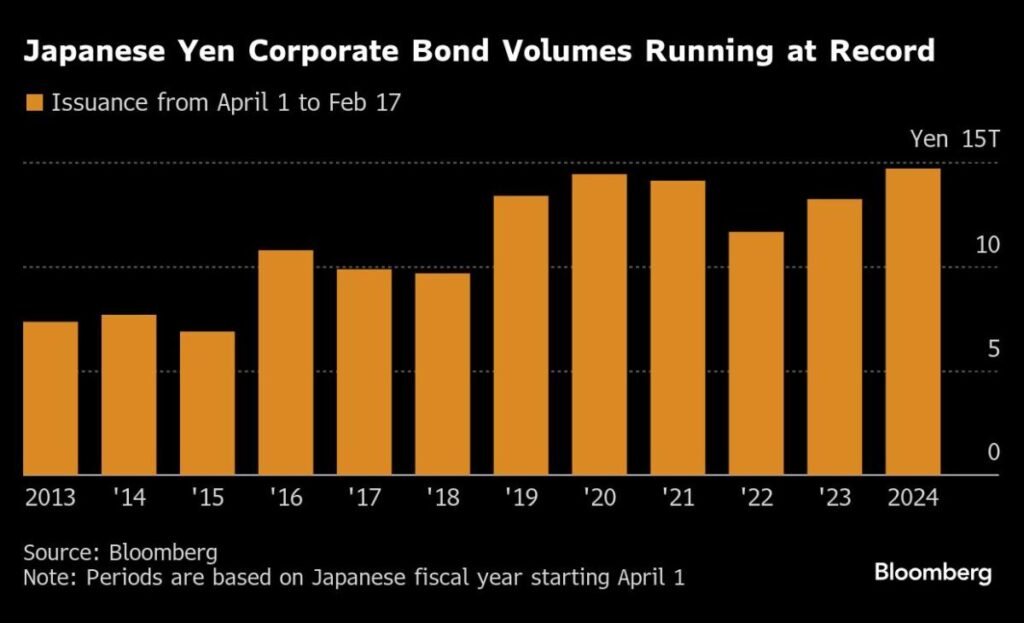

Japanese companies have sold 14.7 trillion yen ($96.8 billion) of local-currency bonds in the current fiscal year, a record for the period, according to data compiled by Bloomberg. A key motivation: locking in funding ahead of an anticipated series of rate hikes, which will push up future borrowing costs.

The issuance surge underscores the sweeping changes taking place in Japan. The central bank has ended the world’s boldest experiment with ultra-loose monetary policy, the economy is finally turning a corner and a series of corporate governance reforms have put pressure on local companies to hunt for growth.

“The range of companies issuing bonds has expanded, and even the same companies are moving to raise larger amounts of capital,” said Hajime Suwa, head of capital markets group at Mitsubishi UFJ Morgan Stanley Securities Co.

The median forecast of economists surveyed by Bloomberg is for rates to climb to about 1.1% in 2027 up from 0.5% now. But many executives stress the positives of higher rates, which are a reflection of the country’s long-anticipated economic recovery.

“The flip side of interest rate increases is growth,” Takashi Ueda, chief executive officer of property developer Mitsui Fudosan Co., said at a briefing. “Short-term, there may be some drawbacks but from a long-term perspective it’s a sign of growth and part of a process of returning to the way things should be.”

Borrowing rates for corporations in Japan are still some of the lowest in the world, even after climbing to an average of 1.39% from around 0.87% this time last year, a Bloomberg bond index shows.

Governance Changes

Companies are also responding to a series of governance changes reverberating throughout Tokyo boardrooms, including rising investor activism and guidance by the Tokyo Stock Exchange that listed companies should improve their valuations and returns to shareholders.

Sony Group Corp. looks set to become the latest flagship name to tap the market, after announcing a 110 billion yen deal that will have a faster-than-usual syndication period — a sign Japan’s bond market is moving closer to global standards.

Story Continues