(Bloomberg) — Bank of Japan Governor Kazuo Ueda signaled a readiness to intervene in the bond market to quell a surge in yields, reiterating the central bank’s long-standing commitment to supporting stability, as the prime minister and finance minister voiced concerns about the potential impact of market moves.

Most Read from Bloomberg

“Moves in bond yields fluctuate to a certain degree,” Ueda said in response to questions in parliament Friday. “However, we will purchase government bonds nimbly to foster the stable formation of yields in exceptional cases where long-term yields rise sharply.”

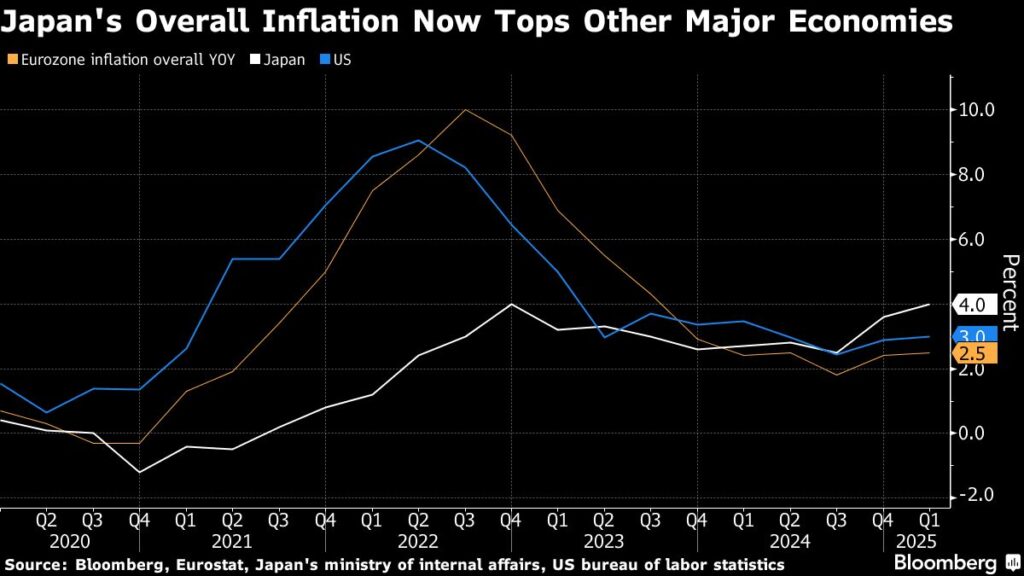

Bond yields fell and the yen weakened following Ueda’s comments. Earlier Friday, benchmark yields touched a fresh 15-year high of 1.455% after consumer inflation accelerated in January.

Prime Minister Shigeru Ishiba, also speaking in parliament, said the topic of high yields didn’t come up when he met with Ueda Thursday, but it’s something he’s monitoring from the perspective of fiscal management.

“A rise in interest rates when there are high debt-to-GDP ratios puts pressure on policy expenses through increased interest payments,” Ishiba said. “I have strong concerns about this.”

Earlier, Minister of Finance Katsunobu Kato told reporters that rising government bond yields may strain Japan’s already tight finances given the nation’s high debt-to-GDP ratio. Japan’s public debt will be 232.7% of gross domestic product this year, according to a report released earlier this month by the International Monetary Fund.

Taken together, the comments show that officials are monitoring markets closely at a time when economists are continuing to assess the outlook for the BOJ’s rate path, incorporating the risks of a faster and steeper tightening cycle in light of recent strong data.

“Markets were looking out for clues from Ueda with regards to the recent rise in JGB yields,” said Christopher Wong, a strategist at Oversea-Chinese Banking Corp. in Singapore. Ueda’s comments “serve as a reminder that the BOJ is watching markets closely, and policymakers can step in if there is any ‘excessive volatility’ in the bond space.”

Ueda gave little hint on whether any bond action might take place in the near term by also saying that yields are determined by the market. The recent yield rise probably reflects the market’s views on the economic recovery and improving inflation trend, he said.

Story Continues