(Bloomberg) — Prime Minister Narendra Modi is counting on a two-pronged stimulus of tax and interest rate cuts to turn around India’s slowing economy, but investors may need more convincing that the measures will be enough.

Most Read from Bloomberg

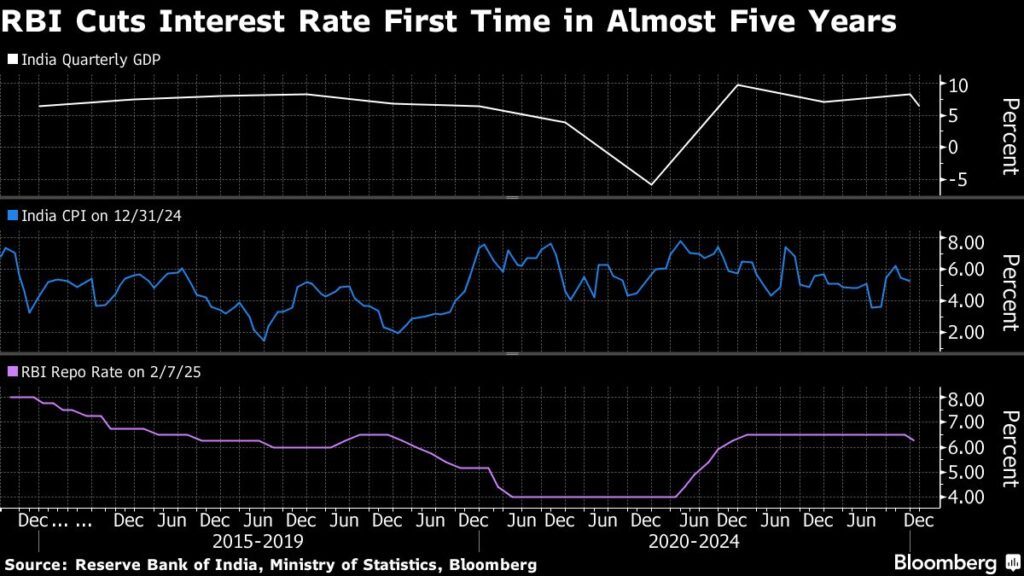

The decision by India’s central bank on Friday to reduce its key rate for the first time in five years comes less than a week after Modi’s government unveiled historic tax cuts in its federal budget. Taken together, the measures underscore the urgency with which Modi’s government is moving to address the growth slowdown gripping the economy.

Yet, investor response to these steps has been muted throughout the week, illustrating the scale of the challenge facing the government. Bonds fell following the central bank announcement, while the benchmark NSE Nifty 50 index lost 0.2%.

Economists said that despite its 25 basis-point cut, the central bank’s overall actions were relatively restrained. The bank’s monetary policy committee voted to retain a “neutral” policy stance rather than change it to “accommodative,” which would have signaled more rate cuts to come.

Despite the tax cuts, the budget was “contractionary” and the central bank’s ability to cut rates in the future is “limited” at a time when the US Federal Reserve is pausing, said Indranil Sen Gupta, an economics professor at Shiv Nadar University.

The rupee’s plunge to record lows means the Reserve Bank of India will need to tread cautiously in cutting interest rates too deeply to avoid undermining the currency, and thereby fuel more inflation.

Moreover, the RBI announced no new liquidity measures that might have given markets a stronger boost, such as a cut to its cash reserve ratio or additional bond buyback measures.

Economists including Kaushik Das at Deutsche Bank AG sees just one more rate cut in this cycle, a 25 basis-point move in April.

“Cutting the repo rate too much in this cycle may put pressure to reverse the easing in a quicker time period, which is not ideal for the economy,” he wrote in a report.

Some economists also question whether New Delhi is relying too heavily on dividend payouts by the central bank to finance its 1 trillion rupees ($11.4 billion) in tax cuts. They also doubt if the reductions can give a significant boost to spending, as only a small fraction of Indian workers pay income taxes.

Story Continues