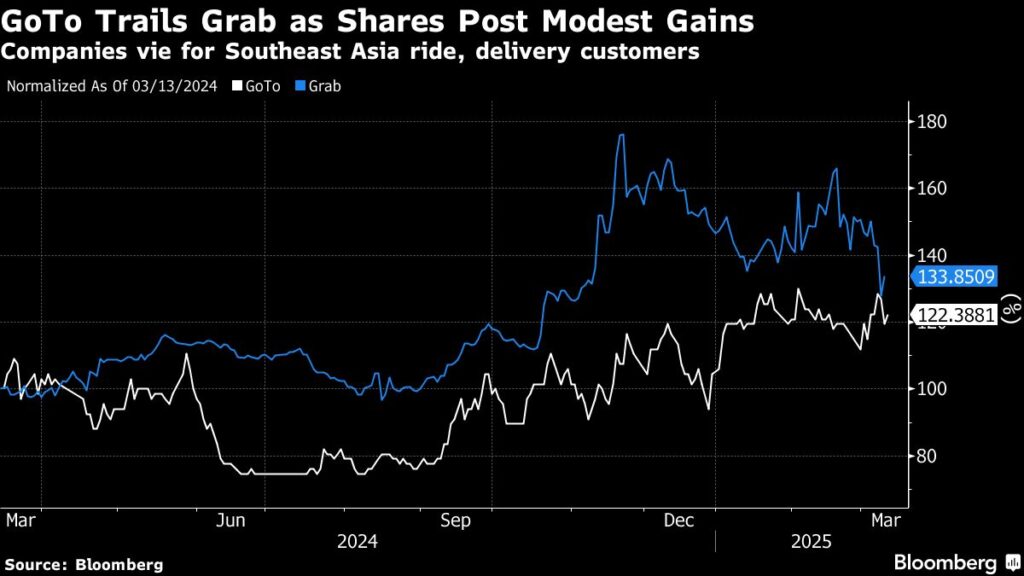

(Bloomberg) — Indonesian ride-hailing and food delivery provider GoTo Group forecast earnings for this year above analysts’ estimates, a sign of confidence as it battles intensifying competition from Grab Holdings Ltd.

Most Read from Bloomberg

It predicted 1.4 trillion rupiah ($85 million) to 1.6 trillion rupiah in adjusted earnings before interest, tax, depreciation and amortization, topping the 1.3 trillion analysts expect on average. It reached its goal of positive earnings on that basis for full-year 2024 and reported fourth-quarter revenue that exceeded estimates.

The forecast highlights GoTo’s efforts to reverse years of losses through drastic measures, including thousands of job cuts and large reduction in marketing spending. Following years of rapid growth, the company has turned its focus on the bottom line after its shares lost 75% since its initial public offering in Jakarta in 2022. But Singapore’s Grab is proving a tough rival, keeping prices low and margins thin for both companies as they battle it out in the Southeast Asian market of 675 million people.

Fourth-quarter adjusted Ebitda rose to 399 billion rupiah from 89 billion rupiah a year earlier on a pro forma basis, GoTo said. Net revenue, which strips out incentives to driver and merchant partners and promotions to users, jumped 90% to 4.2 trillion rupiah on pro forma basis, exceeding the 4.03 trillion rupiah average analyst estimate.

What Bloomberg Intelligence Says

GoTo’s consensus-beating earnings guidance for 2025, is supported by strong prospects for fintech and on-demand services that are creating a solid net-profit track going forward. The Indonesian tech giant achieved its first-ever full-year positive adjusted Ebitda in 2024. The fintech segment, which just broke even in 4Q, is expected to drive at least one-fifth of 2025 Ebitda as its loan book might reach its 8 trillion rupiah goal from 5.2 trillion rupiah now, fueled by high-margin buy-now-pay-later loans to TikTok shoppers. On-demand services should stay the main profit driver amid a ramp-up of faster, premium food delivery services and advertising from merchants.

-Nathan Naidu, analyst

Click here for research

GoTo has also struck deals to improve its profitability. In 2023, GoTo agreed to relinquish control of its e-commerce arm Tokopedia to ByteDance Ltd.’s TikTok. And in a move that would upend the regional market, Grab is now weighing a takeover of GoTo at a valuation of more than $7 billion. While the regulatory hurdles are considerable, both companies have accelerated talks for a combination to end years of losses, Bloomberg News reported.

Story Continues