(Bloomberg) — From ditching US stocks for Chinese peers to buying the yen and the euro, traders are running for cover as they ponder how a US markets meltdown may convulse the world.

Most Read from Bloomberg

What had been a steady drumbeat of US stock selling turned into a stampede on Monday as recession jitters ripped across Wall Street. Risk aversion spilled into Asia, and growing conviction that US exceptionalism is over spurred a rush into the relative safety of the yen, Australian government bonds and the offshore yuan.

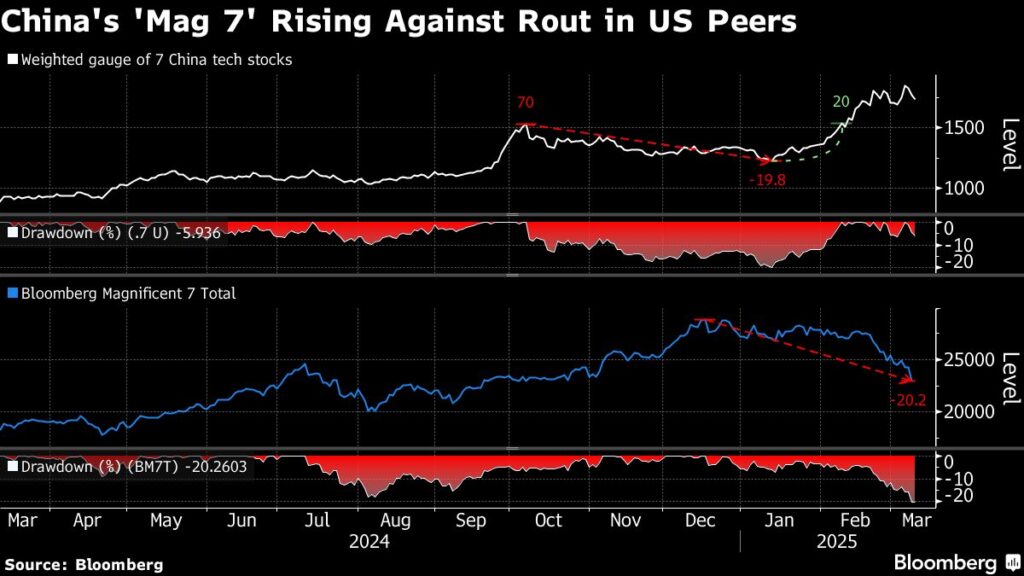

It’s been a dizzying turn of events for investors accustomed to years of US tech gains and a resurgent dollar. A $1.1 trillion wipeout in the Nasdaq 100 Monday underscores how President Donald Trump’s America First policies have, paradoxically, spurred a shift away from US assets. The euro has jumped about 7% from a February low while a gauge of Chinese stocks in Hong Kong has skyrocketed nearly 20% this year.

“Markets right now are like Olympic-level tennis except we, traders, are the ball,” said Calvin Yeoh, portfolio manager at hedge fund Blue Edge Advisors Pte. in Singapore. Yeoh likes long-dated Treasuries and is bearish on US stocks, though “with moderate commitment” amid volatile markets.

A Bloomberg dollar gauge edged lower in Tuesday’s Asia trading while Treasuries extended gains as investors become more convinced that the Federal Reserve would have to resume cutting interest rates to bolster the economy.

In Europe, euro bears have been forced to change their tune as German’s historic defense spending plan spurs upgrades on the common currency’s path.

“US exceptionalism is starting to unravel — you want to preserve capital in this environment,” said Kellie Wood, money manager at Schroders Plc that oversees over $1 trillion globally. The fund last month flipped from buying the dollar to favoring the yen and euro, and is bullish on short-dated Treasuries and Australian government debt, she said.

China Overweight

The pivot has been clear in stocks, where rising fears of a slowdown fueled a 3.8% plunge in the Nasdaq 100 on Monday — the biggest one-day drop since 2022. Nasdaq futures pared losses in Asia to trade little changed on Tuesday.

Economic data give credence to the worries: US unemployment rose to 4.1% in February, while consumer spending fell by the most in nearly four years in January. Comments by Trump that the US could face a “period of transition” and Treasury Secretary Scott Bessent’s remarks that there could be “a detox period” are also encouraging traders to reduce US exposure.

Story Continues