(Bloomberg) — Asian equities traded in a tight range at the open after earnings from Nvidia Corp. failed to rally the stock in after-market hours and new tariff announcements from President Donald Trump caused confusion.

Most Read from Bloomberg

Shares in Australia rose while Japan was steady. Hong Kong equity index futures pointed to a lower open while contracts for the S&P 500 and Nasdaq 100 were little changed in early Asian trade. Nvidia shares swung between gains and losses in after-hours trading. The chipmaker at the center of an AI spending boom, delivered a good-but-not-great quarterly numbers, drawing a muted response from investors accustomed to blowout results.

Treasuries were steady after rallying Wednesday to bring the US 10-year yield four basis points lower to 4.26%, a level not seen since the middle of December. A gauge of the dollar held its gain from Wednesday. Australian yields fell early Thursday.

On Wednesday, Trump said that his administration would impose tariffs of 25% on the European Union. The president said that previously announced levies on Mexico and Canada would come into force on April 2. However his comments were at times contradictory, sewing confusion among investors.

The barrage of tariff news ricocheted through currency markets, lifting the dollar and stemming a selloff in the Canadian dollar and Mexican peso Wednesday, and extending the uncertainty that has weakened equities and cryptocurrencies through the week.

New research suggests Trump’s latest tariffs on imports from China may hit the American economy more than official US trade data indicate.

“The somewhat contradictory statements from the administration around the timing and extent of tariffs is keeping investors off sides,” said Marvin Loh at State Street. “The debate continues as to whether the president will again delay and water down his plans, or if this is the start of the aggressive rhetoric.”

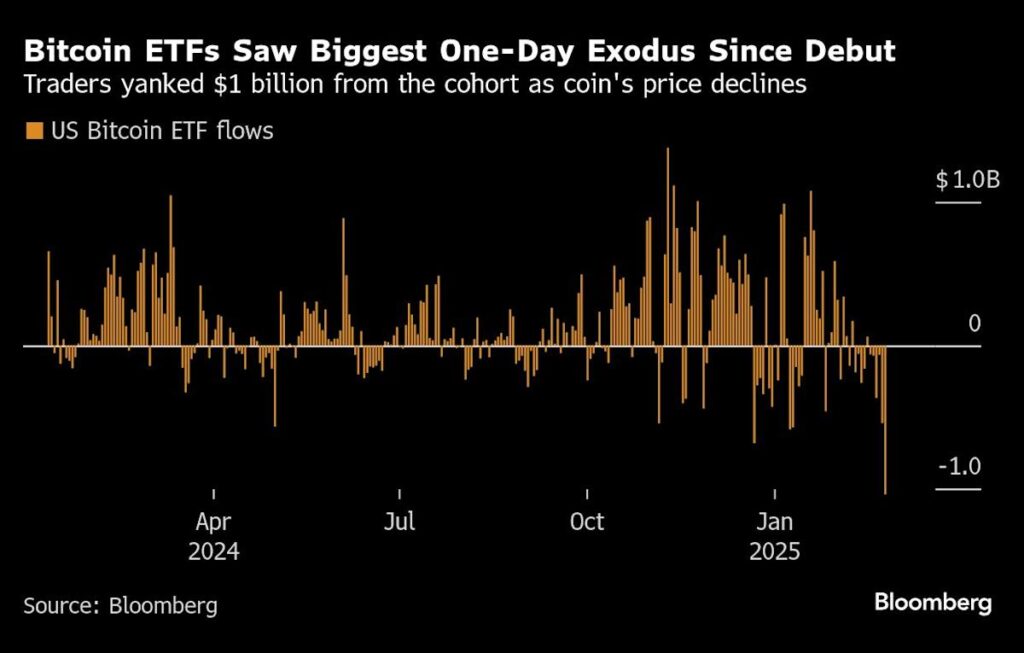

Bitcoin fell to around $84,000, more than a fifth lower than its peak last month, as outflows from exchanged-traded funds amplified selling. Oil fell, while gold was little changed.

In Asia, the yen traded around 149 per dollar after ending Wednesday’s session little changed. Japan’s top currency official on Wednesday indicated he had no issue with growing market expectations over Bank of Japan interest-rate hikes, which this week helped send the yen to a four-month high.

Story Continues

Elsewhere, Australia will release private capital expenditure data while Macau will publish hotel occupancy figures. The G-20 finance ministers and central bank governors will meet in Cape Town. In Europe, Eurozone consumer confidence figures will be released later Thursday, as will US gross domestic product and initial jobless claims.

Nvidia Results

A $330 billion exchange-traded fund tracking the Nasdaq 100 (QQQ) initially rose after the close of regular trading on speculation that Nvidia’s earnings will help reignite the artificial intelligence-driven rally. The giant chipmaker that’s seen as a barometer for AI gave a bullish revenue forecast for the current quarter.

The company got $11 billion of revenue from Blackwell in the fourth quarter, something Nvidia described as the “fastest product ramp” in its history. The outlook comes at a shaky time for the AI industry, with investors concerned about whether data center operators will slow spending.

“Nvidia has swept aside concerns about production of its Blackwell chips, and threats to the boom in demand for computing power with top and bottom line beats for the fourth quarter, and guidance for the current quarter ahead of expectations,” said Derren Nathan at Hargreaves Lansdown.

Key events this week:

Eurozone consumer confidence, Thursday

US GDP, durable goods, initial jobless claims, Thursday

Fed’s Jeff Schmid, Beth Hammack, Patrick Harker, Michael Barr, Michelle Bowman speak, Thursday

Japan Tokyo CPI, industrial production, retail sales, Friday

US PCE inflation, income and spending, Friday

Fed’s Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 9:08 a.m. Tokyo time

Hang Seng futures fell 0.5%

Japan’s Topix rose 0.1%

Australia’s S&P/ASX 200 rose 0.6%

Euro Stoxx 50 futures rose 1.5%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0482

The Japanese yen was little changed at 149.03 per dollar

The offshore yuan was little changed at 7.2657 per dollar

Cryptocurrencies

Bitcoin fell 0.3% to $84,227.48

Ether fell 0.2% to $2,335.53

Bonds

The yield on 10-year Treasuries advanced one basis point to 4.27%

Japan’s 10-year yield declined 1.5 basis points to 1.365%

Australia’s 10-year yield declined two basis points to 4.34%

Commodities

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.