(Bloomberg) — Euro-zone inflation is more likely to get stuck above the European Central Bank’s target than to durably slow, said Executive Board member Isabel Schnabel.

Most Read from Bloomberg

In her opening salvo before a pivotal decision in April on whether to pause interest-rate cuts, the institution’s official in charge of markets shares concerns on prospects for consumer prices in a Handelsblatt article published on Saturday.

“The risk that inflation will remain above 2% longer than expected is higher than the risk that it falls sustainably below 2%,” Schnabel said, according to the German newspaper.

Those remarks may signal her likely opposition to another reduction in April after the ECB’s decision on Thursday to lower its deposit rate by a quarter point. Officials deferred judgment on their next move, and are already preparing for a tough debate at that decision, according to people familiar with their thinking.

Taking time would help policymakers digest a rapidly changing backdrop for the 20-nation economy that could reverberate for years to come. European governments are readying hundreds of billions of euros worth of investments in defense, with Germany also planning to bolster spending on infrastructure.

That massive fiscal boost will bolster the region’s cyclical growth outlook and probably also its output potential and the neutral interest rate, economists at BNP Paribas led by Paul Hollingsworth wrote this week.

“We see a strong case for the ECB to begin raising interest rates as the effects start to materialize — most likely in the second half of 2026,” they said. The economists still expect two more cuts in April and June, taking the deposit rate down from 2.5% to 2%.

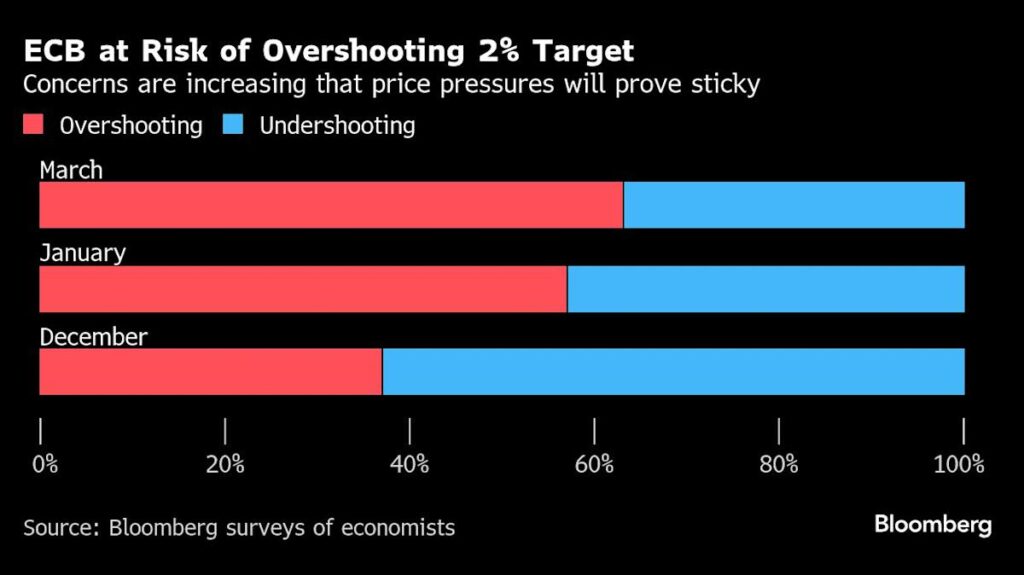

In forecasts released on Thursday, the ECB already pushed back the time when it expects prices pressures to reach 2% from 2025 to early next year. A Bloomberg survey before the Governing Council meeting suggested that economists share Schnabel’s concerns about overshooting the goal.

Schnabel didn’t elaborate on the implications of this risk on the future path for rates in the Handelsblatt article. Before the prospect of a fiscal boost emerged, she was already suggesting that rates don’t necessarily have much further to fall, saying on Feb. 25 that “we can no longer say with confidence that our policy is restrictive.”