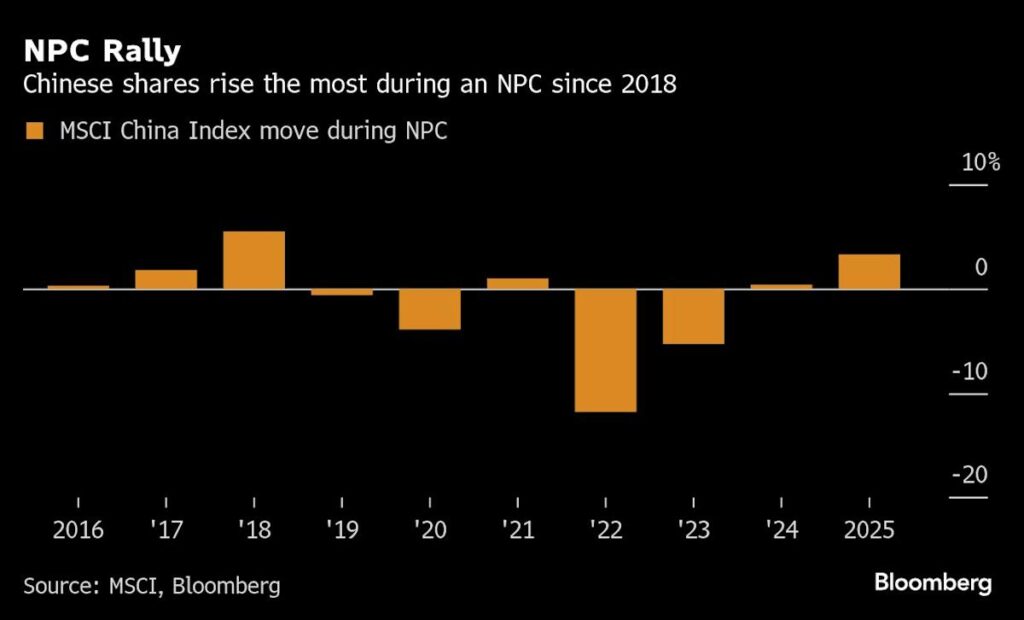

(Bloomberg) — Even with the recent slide, Chinese shares are poised to post their best performance during a National People’s Congress since 2018.

Most Read from Bloomberg

While the MSCI China Index fell Tuesday with Asian shares on concerns over the impact of US President Donald Trump’s new policies, it’s still up more than 3% since the start of the political gathering on March 5. Tech optimism sent the gauge to a three-year high last week, with China offering its support for artificial intelligence during the event.

Mainland investors have piled into Chinese shares traded in Hong Kong, turning them into some of the world’s best performers. Meanwhile, Citigroup Inc. upgraded the market, saying it still looks attractive after the recent rally.

“While a general risk-off sentiment from the US equities selloff is bringing its contagion to the world, I am more optimistic on Chinese equities,” said Francis Tan, Asia chief strategist at Indosuez Wealth Management, adding that investors are looking for alternatives to US shares with “more compelling” valuations.

“The global search has led to China, the underdog,” Tan said.

Back in 2018, Chinese equities were also going through a period of optimism, with the MSCI China Index reaching a 10-year high in January. Skepticism soon resurfaced, and the gauge fell to a 17-month low in October of that year.

–With assistance from Winnie Hsu.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.