(Bloomberg) — China’s money markets are expected to see a liquidity withdrawal of more than 3 trillion yuan ($411 billion) over the remainder of this month, helping to keep funding costs elevated before key meetings of lawmakers in March.

Most Read from Bloomberg

The bulk of the liquidity drain will come from the 2.4 trillion yuan needed to pay back the maturities of so-called policy loans from the central bank. A further 820 billion yuan is expected to be absorbed by bond issuance from local governments, based on monthly estimates from brokerage Huachuang Securities and data compiled by Bloomberg.

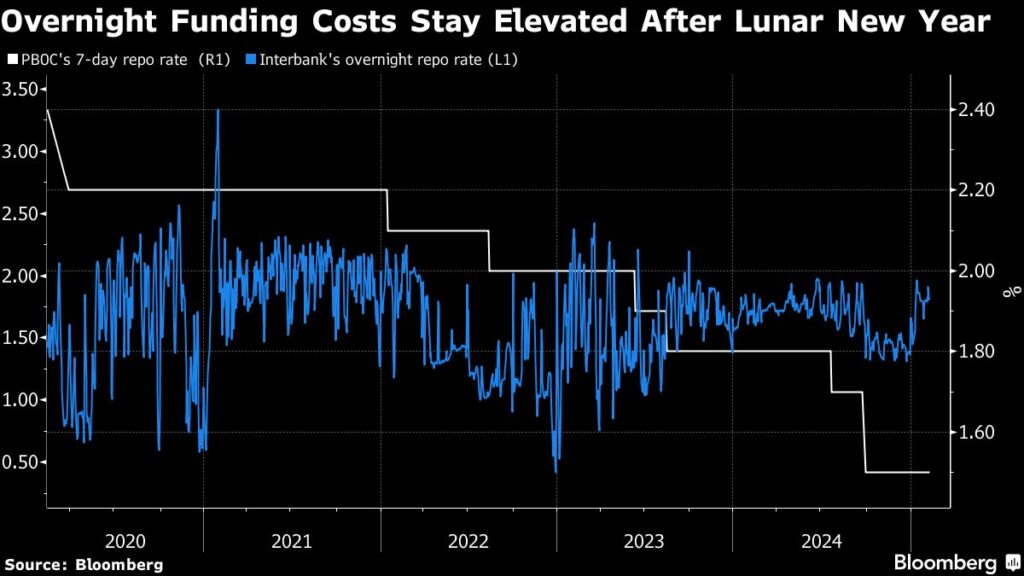

Keeping liquidity tight is seen as beneficial to the authorities as a way to help support the yuan at a time of uncertainty over US tariffs. The People’s Bank of China has drained about 1.5 trillion yuan of funds from the money market through its daily open-market operations since traders returned from Lunar New Year holidays on Feb. 5.

“Ensuring interbank liquidity conditions are relatively tight is indeed helpful in defending the onshore yuan amid such a volatile environment,” said Becky Liu, head of China macro strategy at Standard Chartered Bank in Hong Kong. “China will likely keep things stable for the time being,” especially given the potential negotiations on tariffs between US President Donald Trump and China’s President Xi Jinping, she said.

In one sign of tighter liquidity in the interbank market, the spread between the overnight repo rate and the policy repo rate expanded to as much as 41 basis points this week, near the widest level in four years.

China’s so-called Two Sessions — the annual meetings of the National People’s Congress and the Chinese People’s Political Consultative Conference — are set to take place in Beijing next month. Investors are expecting officials to announce new fiscal-stimulus measures to boost the struggling economy, with some also anticipating additional monetary easing.

It wouldn’t be a surprise if any reduction in the reserve requirement ratio for banks is delayed until March, said Lynn Song, chief economist for Greater China at ING Bank in Hong Kong. “Just from an optics perspective, releasing new monetary easing after the Two Sessions would help send a positive signal for markets.”

The central bank’s maturing policy loans this month include collateral reverse repurchase agreements, medium-term lending facilities — normally known as MLFs — and outright reverse repos.

Story Continues