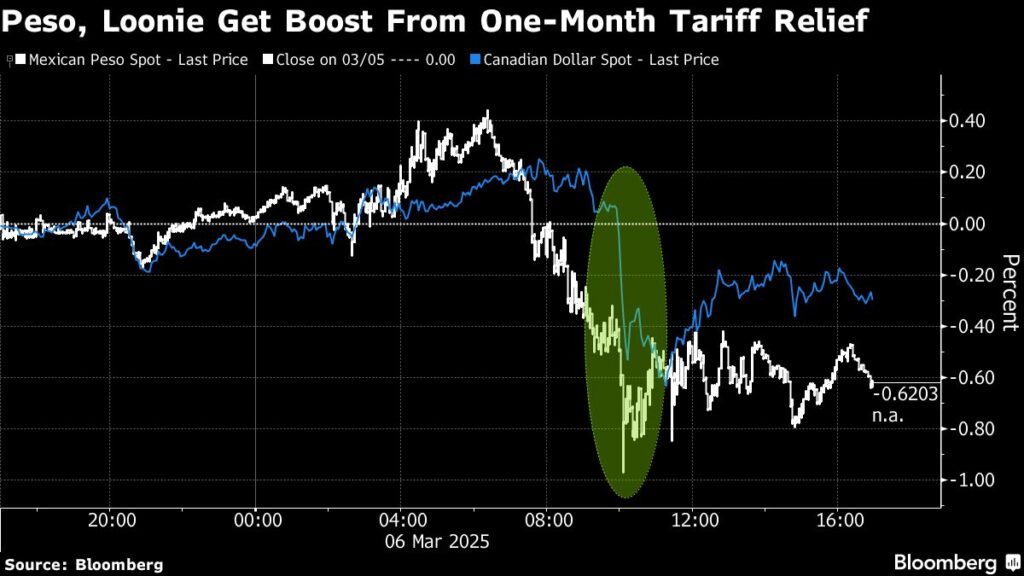

(Bloomberg) — The Canadian dollar and Mexican peso strengthened Thursday as investors cheered a reprieve from crippling US tariffs that came into effect just days ago.

Most Read from Bloomberg

President Donald Trump delayed the tariffs until April 3 for goods covered by the North American trade agreement known as USMCA. The official announcement came after US Commerce Secretary Howard Lutnick signaled earlier in the day that the president might walk back some of the planned levies.

The rapid reversal “helped alleviate growth and inflation concerns from prolonged tariff disruptions,” said Dan Pan, an economist at Standard Chartered Bank.

Trump signed the order to delay tariffs for both countries after starting the day by saying duties would be delayed for Mexico, raising concern Canada wouldn’t be included.

The new date of April 2 is also when the president is expected to start unveiling plans for so-called reciprocal duties on nations around the world as well as sector-specific duties.

The loonie ended the day 0.3% higher against the dollar after rising as much as 0.7%, while the peso posted a 0.6% gain. The Bloomberg Dollar Spot Index dropped as much as 0.4%, down for a fourth session.

“The temporary reprieve from 25% tariffs should allow the CAD to strengthen somewhat in the short run,” said Shaun Osborne, the chief currency strategist at Scotiabank. “But scope for gains is probably limited to the 1.4200 to 1.4250 area in the short run.”

Investors will also take cues from Friday’s US employment report, the dollar’s reaction and new political developments in Canada to determine loonie’s moves, Osborne said.

Mexican President Claudia Sheinbaum held a press conference after her call with Trump Thursday, saying that Mexico’s goal is to avoid US tariffs altogether. The country’s trade team continues to work on a deal with the Trump administration, she said.

Whirlwind

Currencies from both countries have seen frenzied trading in recent days, as markets reacted to shifts in the Trump administration’s tariff plans. The US applied across-the-board 25% tariffs on Canada and Mexico earlier this week, with the exception of Canadian energy, which faced a 10% rate. The two nations have hinted at retaliatory measures.

On Wednesday, Trump offered a one-month exemption to automobiles covered by USMCA, and administration officials were considering exempting certain agricultural imports.

Story Continues