(Bloomberg) — Gabriel Galipolo will chair his first interest rate decision as Brazil’s central bank governor on Wednesday with a clear, well-known mission: the board he now presides will raise the benchmark interest rate by a full percentage point for the second straight meeting.

Most Read from Bloomberg

And yet, investors will be on the edge of their seats, wondering how the 42-year-old economist will leave his mark on monetary policy in Latin America’s largest economy. Many are also worried by lingering doubts about his independence from leftist President Luiz Inacio Lula da Silva.

“Everyone will be looking at every line of the statement,” said Silvia Matos, an economics professor at Fundacao Getulio Vargas. “The outlook has worsened since the last meeting.”

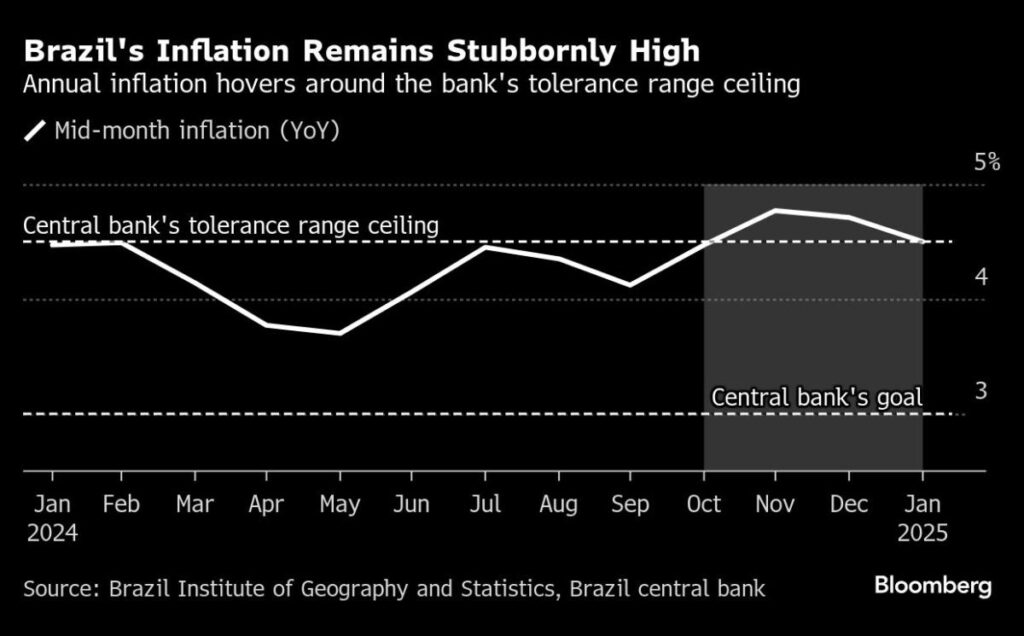

All analysts in a Bloomberg survey see the benchmark Selic rising to 13.25% after markets close today. And after central bankers promised to deliver another rate hike of the same size at their next decision in March, the test will be how the board signals its views on the economy and how in-sync it moves with Lula’s government. That will leave investors scouring the communique for any changes in inflation forecasts and language on public spending, considered a key driver of consumer demand.

What Bloomberg Economics Says

“We think Galipolo will want to build consensus at the start of his term. The two board members not appointed by Lula — who we think are the most hawkish — supported the guidance for a 100-bp hike in January. We expect them to follow through. The three January additions have little incentive to dissent as they begin building inflation-fighting credentials.”

— Adriana Dupita, Brazil and Argentina economist

— Click here for full report

The central bank has raised borrowing costs from 10.5% after halting cuts last May, bucking regional peers such as Mexico and Colombia that have continued to ease. The Federal Reserve is expected to pause its own rate-cutting campaign on Wednesday, hours before Brazil’s decision.

While the central bank’s guidance on additional monetary tightening was welcomed by investors, high rates are complicating Lula’s pledge to boost the economy.

Sensitive Topics

Administration officials argue that Galipolo was unofficially leading the central bank in December, when policymakers said they would keep raising borrowing costs in January and March to fight inflation. The guidance was also designed to fend off investor concerns that Galipolo would be subject to pressure from Lula as soon as he assumed the post.

Story Continues

Lula called Galipolo a “gift” for Brazil in a video posted on social media last month that showed both men shaking hands and the leftist leader promising “total” independence to the new governor. It was a stark contrast to Lula’s public diatribes against Galipolo’s predecessor, Roberto Campos Neto, who had been chosen by former President Jair Bolsonaro.

“I have the president’s full trust,” Galipolo, who previously was an undersecretary to Finance Minister Fernando Haddad, told journalists in December.

Galipolo and Lula don’t agree on everything, according to officials with knowledge of their thinking. Their meetings are a space to discuss sensitive topics, helping Lula understand the importance of fiscal responsibility and the need to lift rates to tame inflation, the people said, requesting anonymity because the talks aren’t public.

In the next few months, Brazil’s rapidly worsening inflation outlook will likely “gain notoriety” in the board’s communication, giving it reason to turn more hawkish, said Carla Argenta, chief economist at CM Capital.

“It’s something the market cares about deeply,” Argenta said. “It matters for economic theory, and it would reinforce the board’s commitment to its inflation goal.”

Skeptical Investors

With the government studying lower import taxes to tame food inflation that’s hurting Lula’s popularity, investors will read carefully into the bank’s comments on public spending. While Chief of Staff Rui Costa ruled out the use of subsidies, investor mistrust over Lula’s commitment to fiscal responsibility still weighs on assets including the real, which plunged over 20% last year.

Skeptical investors are also quick to point out that, on top of tapping Galipolo, Lula has nominated the majority of current bank board members. Those ties could give the leftist leader influence in monetary policy decisions.

“They are likely to be less critical of the government, looking for harmonization between monetary and fiscal policies,” said Lucas Farina, an economic analyst at Genial Investimentos. “We expect them to stop criticizing fiscal policy as much.”

Until now, policymakers have reiterated their next steps will be guided by the board’s “firm commitment” to tame price pressures. Galipolo has said the bar was “too high” for any change to the bank’s guidance.

Earlier in January, Economic Policy Director Diogo Guillen reinforced his confidence in having the “tools needed” to lower inflation as monetary policy heads into “quite restrictive” levels.

“They should make it clear their role is to persist,” said Matos, from Fundacao Getulio Vargas. “Any changes to that pledge would just be terrible.”

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.