(Bloomberg) — Bond yields climbed after Federal Reserve Chair Jerome Powell signaled patience before cutting interest rates further and as investors look ahead to the upcoming US CPI data. Hong Kong stocks rallied, powered by gains in Alibaba and BYD.

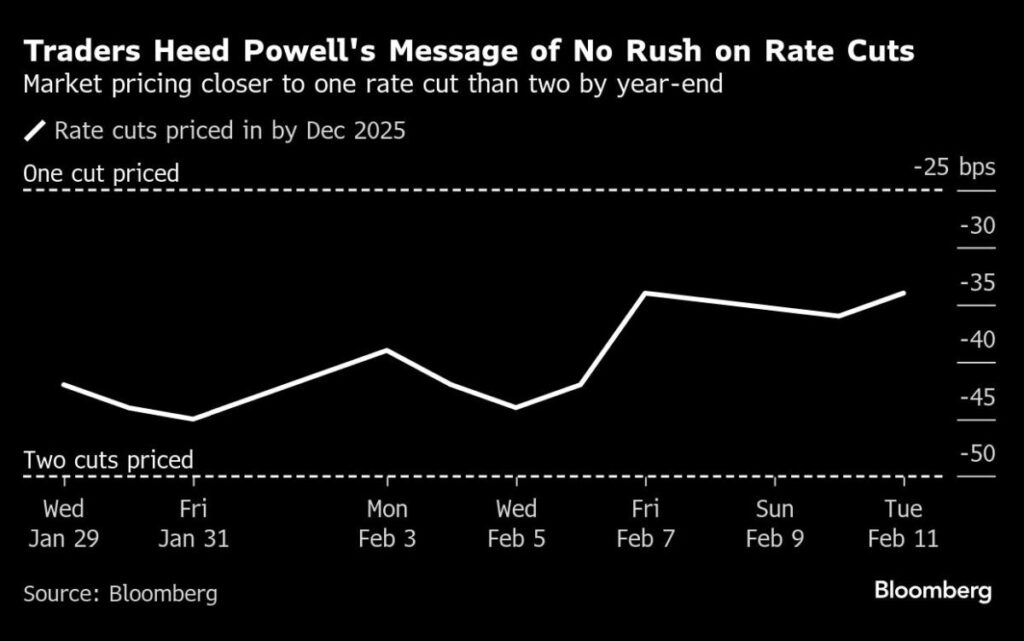

Treasuries edged lower after falling across the curve on Tuesday, with money markets still fully pricing in one rate cut by the Fed this year. Australian and Japanese 10-year yields gained. The yen declined for a third consecutive day. US equity index futures were marginally lower while contracts in Europe rose.

Investors are cautious ahead of Wednesday’s CPI data even as Powell told Congress that the Fed doesn’t need to rush to adjust interest rates, indicating how the economy remained strong. The Fed had left its key policy rate unchanged in January, suggesting the stalled progress toward lower inflation warranted a patient approach.

“The market is taking Powell’s comments in stride,” said Frederic Neumann, chief Asia economist at HSBC Holdings Plc in Hong Kong. “Few believed that Fed was quick to the trigger on further rate cuts, though the door remains open for some easing later in the year.”

The technology theme continued to impact stocks in China and Hong Kong. Alibaba Group Holding Ltd. rose as much as 8.6%, the most since September 2024, after The Information reported that Apple Inc. is partnering with the company to bring AI features to products in China.

DeepSeek news has also helped lift the Hang Seng Index with UBS strategists including James Wang saying that the rally in Chinese stocks spurred by DeepSeek’s artificial intelligence app may be “less than halfway” done. Wall Street strategists from Morgan Stanley and JPMorgan Chase & Co. have also echoed this view.

BYD Co. surged to a new record, reflecting optimism that the Chinese electric vehicle leader will further challenge peers like Tesla Inc. through its smart-driving strategy.

The yen is on track for its longest losing streak in more than a month amid heightened concerns Japan may be included in President Donald Trump’s tariff plan. The currency was the worst performer among its Group-of-10 peers on Wednesday. The Japanese government asked Trump on Wednesday to exempt the nation’s companies from his fresh tariffs.

“There is a genuine risk that Japan may be hit and this can complicate the near term outlook for yen,” said Christopher Wong, a strategist at Oversea-Chinese Banking Corp. in Singapore.

In Asia, India’s rupee extended gains after rallying by the most in over two years Tuesday on suspected strong intervention by the central bank. Vietnam’s dong fell to a record low against the dollar on Tuesday.

Key Inflation

As traders await a key US inflation reading later today, prices have showed scant signs of downward momentum at the start of the year. Healthy job growth has also buoyed the economy, backing the Fed’s stance to hold the line on interest rates for now.

Bureau of Labor Statistics figures due on Wednesday, shortly before the second half of Powell’s two-day testimony marathon, are forecast to show the consumer price index excluding food and energy rose 0.3% in January for the fifth time in the last six months.

“Recent inflation prints, coupled with a strong jobs market, will allow patience from the Federal Reserve who will likely hold policy at its target range of 4.25%-4.50% in March,” said Josh Hirt at Vanguard.

Money markets continued to fully price in just one quarter-point rate cut by the central bank this year, by September. In December, two 2025 cuts were priced in. A strong January jobs report released Friday prompted reassessment of the policy outlook, and January inflation data to be released Wednesday could do the same.

In commodities, oil edged lower after an industry report indicated a large increase in US crude stockpiles. Gold edged down for a second day after a volatile trading in its previous session saw it surge to a fresh peak above $2,942.

Key events this week:

US CPI, Wednesday

Fed Chair Jerome Powell testifies to House Financial Services panel, Wednesday

Fed’s Raphael Bostic and Christopher Waller speak, Wednesday

Eurozone industrial production, Thursday

US initial jobless claims, PPI, Thursday

Eurozone GDP, Friday

US retail sales, industrial production, business inventories, Friday

Fed’s Lorie Logan speaks, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 1:32 p.m. Tokyo time

Japan’s Topix fell 0.2%

Australia’s S&P/ASX 200 rose 0.5%

Hong Kong’s Hang Seng rose 1.6%

The Shanghai Composite was little changed

Euro Stoxx 50 futures rose 0.2%

Currencies

The Bloomberg Dollar Spot Index rose 0.1%

The euro was unchanged at $1.0361

The Japanese yen fell 0.7% to 153.63 per dollar

The offshore yuan was little changed at 7.3149 per dollar

Cryptocurrencies

Bitcoin fell 1.1% to $95,321.46

Ether fell 1.4% to $2,586.49

Bonds

The yield on 10-year Treasuries advanced one basis point to 4.55%

Japan’s 10-year yield advanced 2.5 basis points to 1.340%

Australia’s 10-year yield advanced eight basis points to 4.46%

Commodities

West Texas Intermediate crude fell 0.3% to $73.07 a barrel

Spot gold fell 0.3% to $2,888.03 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Toby Alder.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.