(Bloomberg) — Asian stocks trimmed gains and European equity index futures fell amid concerns about talks on Ukraine and a pullback in Chinese shares.

Most Read from Bloomberg

Mainland China’s benchmark stock index and a gauge of Asian equities swung to a loss, while Hong Kong-listed technology stocks dropped from near a three-year high. US and Russia begin high-level talks in Saudi Arabia Tuesday over how to end the war in Ukraine, without anyone from Kyiv taking part.

The dollar strengthened against all of its Group-of-10 peers, with Bloomberg’s gauge of the greenback snapping a three-day decline. US Treasuries dropped as trading resumed Tuesday after the Presidents’ Day holiday. Earlier, Federal Reserve Governor Christopher Waller said recent economic data supported keeping US interest rates on hold until more progress was seen in inflation.

“There is no clear driver for the weaker tone in markets this afternoon,” said Frederic Neumann, chief Asia economist at HSBC Holdings Plc in Hong Kong. “The focus remains now on the next catalyst, with investors looking for direction after the recent rally.”

Chinese stocks had rallied earlier in the Asian session following a meeting between China’s President Xi Jinping and business leaders on Monday. Several analysts saw the conclave as a possible end to the years-long crackdown on the private sector.

Xi’s meeting drew many of the biggest names in Chinese business over the past decade, representing industries from chip making and electric vehicles to AI. The summit demonstrated Beijing’s softer stance toward the companies that fuel most of economy, just as Washington ramps up a potentially debilitating campaign of global tariffs.

In Europe, investors will turn their attention to the talks in Saudi Arabia, which follow a landmark phone call between President Donald Trump and his Russian counterpart Vladimir Putin last week.

On Monday, European bonds slipped and shares in defense companies rallied on the likelihood of greater military spending, which could force governments to step up borrowing in the coming years.

Meanwhile, Fed Governor Waller said if US inflation behaves as it did in 2024, policymakers can get back to cutting “at some point this year.”

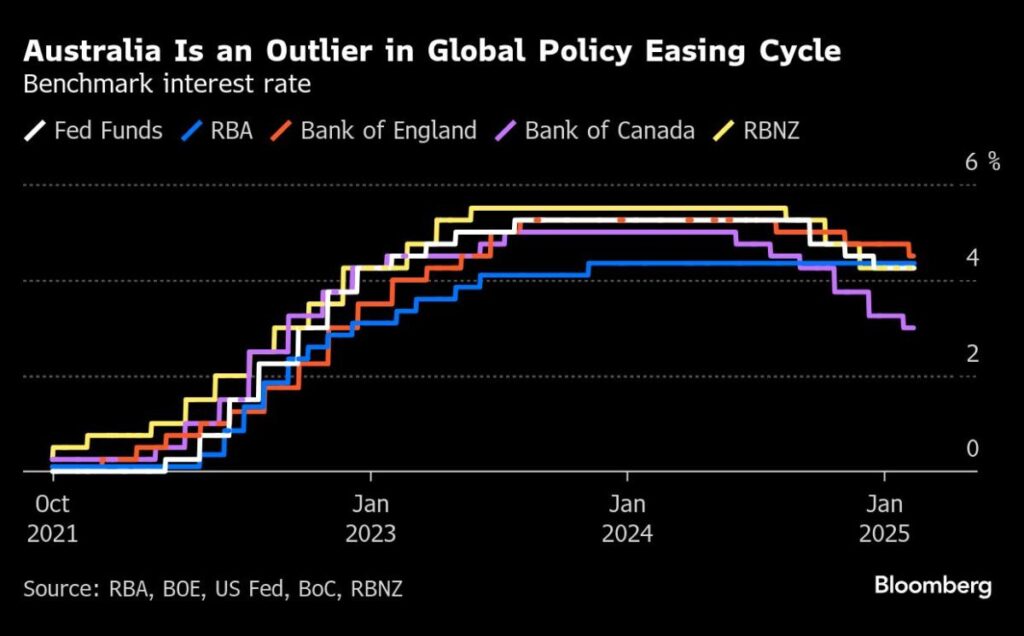

Australian stocks extended losses after the central bank cut its policy rate. The Aussie climbed briefly climbed before paring gains after the country’s central bank said it remains cautious on future easing after lowering official cash rate.

Story Continues