(Bloomberg) — A relief rally in global stocks is expected to gather pace in Asia after China said it would take steps to revive consumption in the world’s second largest economy.

Most Read from Bloomberg

Equity futures in Australia, Japan and Hong Kong all rose, tracking gains in the US. The S&P 500 jumped 2.1% on Friday as the government avoided a shutdown, while the tech-heavy Nasdaq 100 advanced 2.1%. The Golden Dragon index rose 2.7% with Chinese authorities set to announce measures to boost consumption on Monday. The dollar was steady.

The relief comes after a global selloff since mid-February following on-and-off-again import tariffs, recession calls, heightened tensions between the US and its closest allies and concerns over a government spending. Gauges of global and American shares had slumped to their lowest since September last week before rebounding.

However, Chinese equities have outperformed, trading at the highest since December after an ambitious growth target of about 5% this year was set amid euphoria over AI. Traders are now seeing an extension to the rally after Xinhua reported authorities will give details on policies to stabilize stock and real estate markets, lift wages and boost the nation’s birth rate. A swath of Chinese data including industrial production and retail sales prints for February due Monday will also be closely parsed.

“The initiatives announced over the weekend are targeted to boost the flagging animal spirits of the Chinese consumer,” said Tony Sycamore, an analyst at IG in Sydney. That “should help support the relief rally in global equity markets that commenced on Friday and the continued outperformance of China equity markets.”

The S&P 500’s advance on Friday was the biggest since the aftermath of the November presidential election. Not even growing apprehension among consumers over US trade policies prevented the relief rally that followed a selloff that culminated in a 10% plunge of the US equity benchmark from its peak last week.

As the demand for haven assets waned, Treasury yields rose across the curve, led higher by their German counterparts after Chancellor-in-waiting Friedrich Merz said Friday that an agreement had been reached with the Green party on the debt-funded defense and infrastructure package. The euro strengthened for a second week, and remained near its strongest against the greenback since November ahead of a vote on the plan on Tuesday.

“The German fiscal package is formidable and likely opens the way for such moves to be matched by other EU nations” and removes the negative tail for the euro, Barclays strategists including Themistoklis Fiotakis wrote in a note to clients. However “the bulk of the euro-dollar rally may also be behind us, due to drastically worsening dollar sentiment versus earlier in the year and an already priced-in fiscal reform.”

Central Bank Bonanza

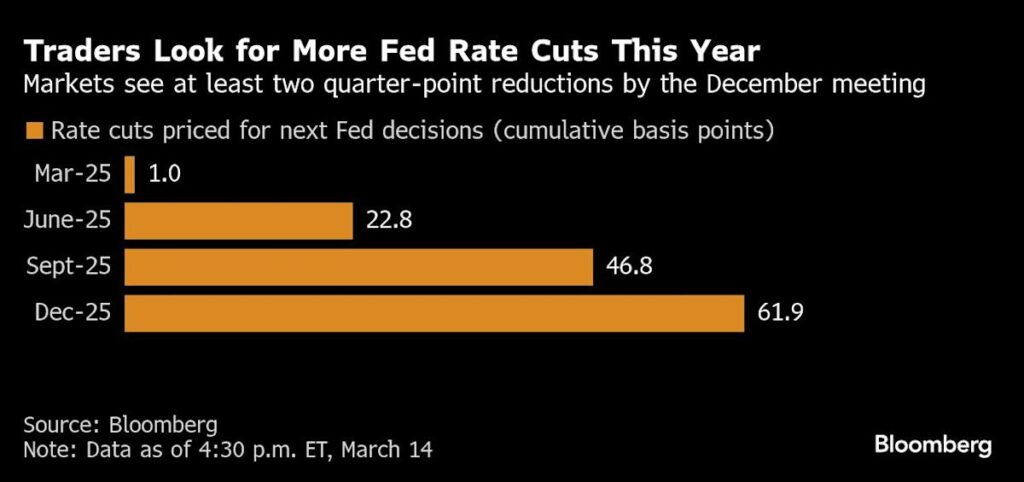

Investors will also be monitoring to a swath of central bank meetings this week as President Donald Trump’s trade salvos test policymakers’ nerves. The Bank of Japan is expected to keep its rate steady after a hike last month and the Bank of England is expected to stand pat. Federal Reserve Chairman Jerome Powell Jerome faces a tricky task of both assuring investors the economy remains on solid footing and policymakers are ready to step in with support.

“Markets will closely scrutinize the updated Summary of Economic Projections” which are likely to lower estimates by the Fed for economic growth and revise core inflation forecasts a little higher, Commonwealth Bank of Australia strategists including Joseph Capurso wrote in a note to clients. “However, the ‘dot plot’, which captures members best estimate of the Funds rate at the end of each calendar year, may not change if FOMC members expect the increase in core inflation to be temporary.”

In commodities, oil notched its first weekly gain in eight weeks on Friday as the US stepped up military strikes on Yemen’s Houthi militants. Gold closed lower on Friday for the first time in four days amid risk sentiment.

Key events this week:

China property prices, retail sales, industrial production, Monday

Italy CPI, Monday

US retail sales, Empire manufacturing, Monday

OECD reports on near-term prospects for the global economy, Monday

Canada CPI, Tuesday

US housing starts, import price index, industrial production, Tuesday

ECB Governing Council member Olli Rehn speaks, Tuesday

Argentina GDP, trade, Wednesday

Brazil rate decision, Wednesday

Eurozone CPI, Wednesday

Indonesia rate decision, Wednesday

Japan rate decision, industrial production, Wednesday

US Fed rate decision, Wednesday

Australia unemployment, Thursday

China loan prime rates, Thursday

New Zealand GDP, Thursday

South Africa rate decision, Thursday

Sweden rate decision, Thursday

Switzerland rate decision, Thursday

Taiwan, rate decision, export orders, Thursday

UK rate decision, jobless claims, unemployment, Thursday

US jobless claims, existing home sales, Thursday

EU leaders summit in Brussels to discuss defense spending, Thursday

ECB President Christine Lagarde speaks, Thursday

Bank of Canada Governor Tiff Macklem speaks, Thursday

Chile rate decision, Friday

Eurozone consumer confidence, Friday

Japan CPI, Friday

Malaysia CPI, Friday

Russia rate decision, Friday

New York Fed President John Williams speaks, Friday

Some of the main moves in markets

Currencies

The euro was little changed at $1.0882 as of 6:27 a.m. Tokyo time

The Japanese yen fell 0.1% to 148.81 per dollar

The offshore yuan was little changed at 7.2365 per dollar

The Australian dollar was unchanged at $0.6324

Cryptocurrencies

Bitcoin fell 0.3% to $82,931.74

Ether rose 0.1% to $1,896.98

Stocks

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Richard Henderson.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.