(Bloomberg) — The euphoria over Chinese stocks has hammered much of the country’s debt market, with a notable exception: convertible bonds.

Most Read from Bloomberg

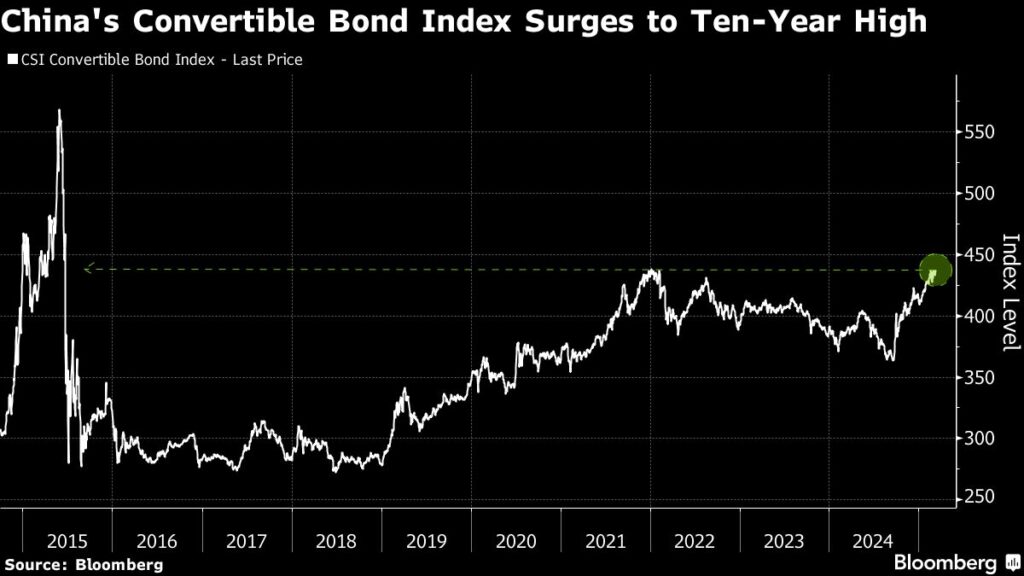

The CSI Convertible Bond Index, a gauge measuring the performance of such notes listed in Shanghai and Shenzhen, rose 0.3% on Monday to its highest level since 2015. The advance comes as a rally in Chinese equities boost the appeal of debt that can be converted into equities. Convertible bonds are headed for a seventh straight month of gains, the longest such streak since early 2020.

With a maturity wall looming for the securities this year, the supply and demand dynamic is also improving. While the massive payment due was deemed a risk, sentiment has turned more favorable after a slew of issuers including China Citic Bank Corp. redeemed their debt.

The outstanding amount of the securities has dropped about 30 billion yuan ($4.1 billion) this year, according to Kangtai Song, senior analyst at Topsperity Securities Co. With strong performance in equity sectors such as AI and robotics, convertible bonds in related industries have also benefited, Song added.

–With assistance from Mengchen Lu.

(Updates with analyst comment in the fourth paragraph)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.