(Bloomberg) — Chinese consumption, investment and industrial production exceeded estimates to start the year, pointing to signs of resilience for an economy still in need of more stimulus as Donald Trump’s tariffs threaten growth.

Most Read from Bloomberg

The upswing suggested Beijing’s pro-growth pivot since late September continued to feed momentum for the world’s second-biggest economy. At the same time, the property market stayed under pressure and unemployment rose, a sign of vulnerabilities that could be exposed if US tariffs inflict more pain across China’s manufacturing sector.

Follow The Big Take daily podcast wherever you listen.

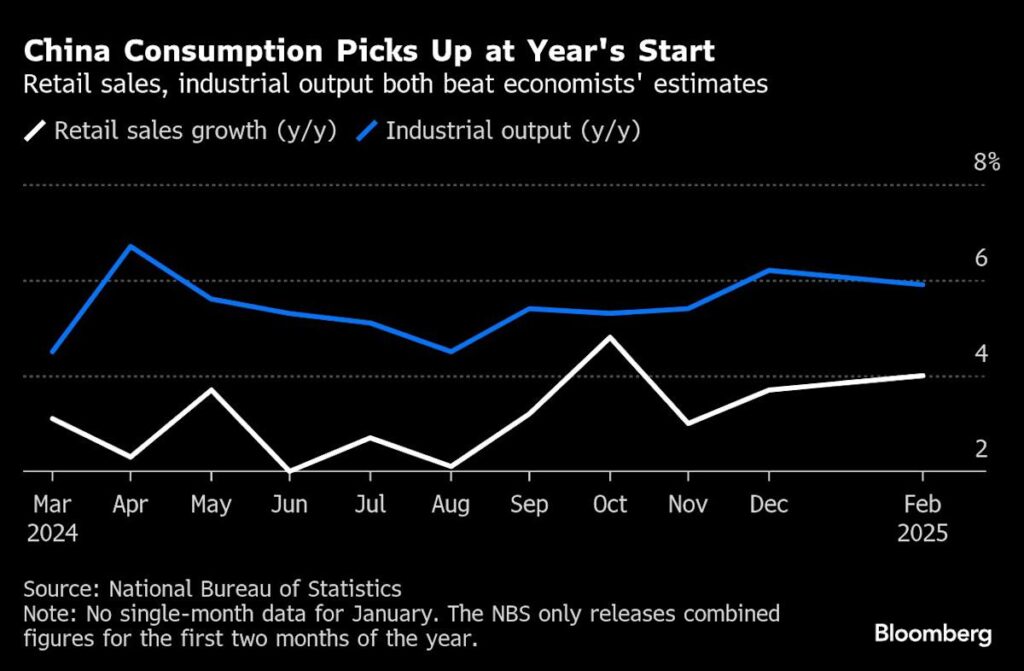

Retail sales clocked their best reading in the first two months since October, the National Bureau of Statistics said Monday, while industrial output exceeded the median estimate in a Bloomberg survey of analysts. Growth in fixed-asset investment marked the fastest since the gain in the first four months of 2024.

“Significant uncertainties remain, but we feel that upside and downside risks are roughly evenly balanced,” said Lynn Song, chief economist for Greater China at ING Bank.

So far, investors weren’t too impressed with the seemingly upbeat data. Chinese stocks traded in a narrow range, with the benchmark CSI 300 Index 0.2% lower at the close.

China’s 10-year bonds extended declines, pushing the yields up by seven basis points to 1.895%. Futures contracts on the 30-year debt posted the worst day so far in 2025.

Tariff Shock

The figures provide the most comprehensive snapshot yet of how China’s economy has fared since Trump embarked on a new trade war. An expanded program to subsidize consumers and businesses who trade in old equipment is helping lift demand, while front-loading of shipments by exporters is propping up manufacturing.

As authorities increasingly turn the attention on generating more consumption — their top priority this year — the goal is to shift from what one official called China’s previous “supply-focused” approach to one driven by both supply and demand.

Speaking at a press conference in Beijing on Monday to present a plan to rekindle domestic demand, a deputy head of China’s top economic planning agency said the latest effort will also rely on measures that promote households’ income and boost their spending power.

A central banker who appeared on the same panel said the People’s Bank of China is also studying the possibility of aiding the consumer by offering financial assistance and creating new policy tools to increase low-cost support.

Senior economic officials said recently they carved out plenty of room to act in the face of uncertainty and risks, after the government announced an ambitious growth target for 2025 of around 5% at the annual session of the Communist Party-controlled parliament that concluded last week.

“China rarely fails to achieve its growth target, and we expect that policy support will continue to roll out to help offset the tariff impact on growth this year,” ING’s Song wrote in a note after the data release, as he revised up his growth forecast for this year to 4.7% from 4.6% earlier.

Economists at Australia & New Zealand Banking Group also upgraded their growth projection of the country’s gross domestic product after the data release, to 4.8% for 2025 from 4.3% previously.

China’s statistics bureau combines data for January and February to smooth out distortions caused by the irregular timing of the Lunar New Year holiday.

China’s front-loading of shipments abroad has been supporting industrial production at the start of the year, while an early roll-out of fiscal stimulus this year contributed to faster infrastructure investment growth, according to Jacqueline Rong, chief China economist at BNP Paribas SA. Exports reached a record $540 billion in the first two months of the year.

However, a prolonged property sector slowdown continues to weigh on the economy and higher tariff woes loom ahead, she cautioned. The floor space of new home sales shrank again in the last two months and property development investment slumped 9.8%, according to NBS numbers.

“The real estate sector will remain a drag on the economy this year,” Rong said. “Looking forward, the tariff impact on exports will become evident sooner or later, and the downside risks on exports will definitely show up.”

Lifting consumer spending is key to countering US policies that are upending global trade and causing a slowdown of Chinese exports, which contributed to nearly a third of the country’s economic expansion in 2024.

As part of an effort to boost domestic spending, policymakers earlier expanded China’s trade-in program for consumer goods and introduced measures to restore household confidence.

The latest data reflected demand for goods that were eligible for subsidies. Retail sales of products ranging from furniture to home appliances rose sharply. Holiday makers also splurged during the week-long Chinese New Year break through early February.

Highlighting the government’s push to sustain the recovery momentum in household spending, policymakers over the weekend unveiled the special action plan aimed at reviving consumption. The guidelines published by the State Council, China’s cabinet, prioritized measures on raising incomes, stabilizing the stock and real estate markets, and offering incentives to raise the country’s birth rate.

What Bloomberg Economics Says…

“China’s economy performed better than expected in the first two months of the year, but stimulus remains essential to keep the recovery going.”

— Chang Shu and David Qu. For full analysis, click here

China could also further expand its trade-in program after first reviewing the effectiveness of existing measures, according to Li Chunlin, vice chairman at the National Development and Reform Commission. Household confidence and demand remain weak in a consumption environment that needs to be improved, Li said at the Monday briefing in Beijing about the action plan.

Li and other officials at the news conference provided little additional detail beyond what was said in the earlier announcement.

Citigroup Inc. anticipates “a window for policy implementation” over the next few months, with a cut in the amount of cash banks must keep in reserve next quarter and a rate reduction in the subsequent three months. China’s leadership will likely use the mid-year Politburo meeting to assess progress it said.

“All eyes could be on property and consumption support, as well as Supply-Side Reform 2.0” to cut capacity, Citigroup economists including Xiangrong Yu said in a report Monday. “Looking ahead, growth momentum could weaken as external headwinds gather.”

–With assistance from Iris Ouyang, Rebecca Choong Wilkins and Zhu Lin.

(Updates throughout.)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.