(Bloomberg) — Earnings momentum is shifting away from the US and toward Europe and parts of Asia.

Most Read from Bloomberg

Dollar strength has created headwinds for the US, while improving economic prospects and stimulus measures are providing support in the other two regions.

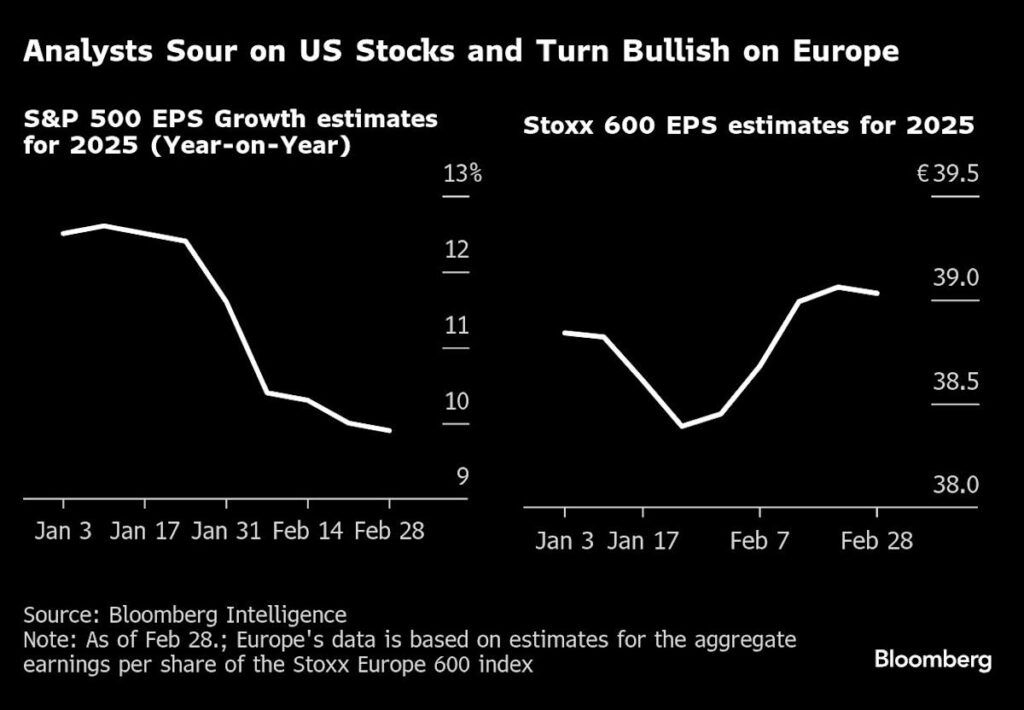

Analysts have been revising their 2025 earnings growth estimates for the S&P 500 downward since mid-January, according to data from Bloomberg Intelligence. In contrast, earnings estimates for Europe have been raised.

The shift comes as S&P 500 companies reported the most profit misses since the fourth quarter of 2022, while the MSCI Europe Index saw a smaller miss rate than the previous quarter.

Gloomy economic readings and uncertainty regarding US policy has weighed on estimate sentiment, said Gaurav Mallik, Pallas Capital Advisors’ chief investment officer.

US companies face significant risks from a major drop in government spending, and the Federal Reserve has indicated it’s not rushing to cut rates, said Kristina Hooper, Invesco’s chief global market strategist.

Europe’s economy, meanwhile, surprised on the upside by eking out modest growth in the final quarter of 2024. The European Central Bank is more likely to cut rates this year to stimulate growth. And gaps left by a drop in US defense spending will be plugged by Europe, Hooper said.

A strong US dollar is also eating into American companies’ earnings abroad. The Bloomberg Dollar Spot Index has strengthened about 3% in the past six months, even after weakening this week. McDonald’s Corp. sees dollar strength trimming full-year earnings per share by 20 cents to 30 cents. Amazon.com Inc. took an additional $700 million hit from foreign exchange in its fourth quarter. Uber Technologies Inc. said it expects its top line to suffer, though it’s trying to mitigate the risk.

Companies are navigating growing global turbulence and weakening consumer sentiment because of concerns over tariffs and rising prices. Both Honeywell International Inc. and Walmart Inc. issued disappointing outlooks, citing geopolitics and tempered demand. Lee and Wrangler owner Kontoor Brands Inc. said consumers are “confused” and feeling “under attack.”

Tariffs are likely “modestly priced in” to forecasts, Hooper said, though uncertainties around the duration and scale make it difficult to be precise.

Analysts have raised 2025 estimates for European companies during this earnings season. Potential catalysts for earnings this year include the election victory of a pro-business candidate in Germany and Ukraine peace talks, BI analysts Kaidi Meng and Laurent Douillet said.

Negative earnings per share revisions have stopped since the start of the reporting season in mid-January, Goldman Sachs strategists said in a Feb. 14 note. Upgrades are mainly driven by the retreat of a bearish outlook on European equities, supported by favorable currency moves, Citi analysts said in a Feb. 17 note.

Engine-maker MTU Aero Engines AG, which supplies Airbus SE and Boeing Co. and books most of its orders in dollars, cited favorable exchange rates when it boosted guidance.

InterContinental Hotels Group Plc expects greenback strength to “push the US to travel more overseas again,” Chief Financial Officer Michael Glover said in a recent interview.

Tariffs remain the biggest threat to Europe’s upbeat outlook. Sectors that have seen the sharpest earnings downgrades – autos, chemicals, steel and aluminum — are the most vulnerable to a trade war, Goldman Sachs’ portfolio strategist Lilia Peytavin said.

Elevated energy prices and a lack of dynamism in the economy may also threaten the sustainability of Europe’s earnings gains, Mallik added.

China Recovery, India Slowdown

Asia’s outlook is mixed, with prospects in China brightening, while dimming in Japan and India.

Forecasts for earnings growth in China have lifted modestly amid government stimulus programs, BI said. Major firms including Xiaomi Corp. and Midea Group Co. should benefit from increased consumer subsidies. Better-than-expected results from Alibaba Group Holdings Ltd. and Lenovo Group Ltd., coupled with DeepSeek’s breakthrough, also boosted sentiment.

Policies focusing on subsidies and boosting consumer confidence unveiled at China’s National People’s Congress, which got under way this week, are key to improving the long-term earnings outlook, said Cusson Leung, chief investment officer for KGI Asia.

A stronger yen and tariffs on Japanese exports are dampening investors enthusiasm for stocks there. In South Korea, a 25% US levy on steel imports will hurt steelmakers as the US accounts for around 13% of their exports, BI said.

In India, 40 of the companies in the benchmark Nifty 50 index saw the average analyst expectation for the 2026 financial year trimmed after the earnings season, with executives citing a slowdown in domestic demand and rising input costs.

In Southeast Asia, estimates for Singapore banks may be nudged higher on strong wealth demand, better lending and slower Fed easing, BI said.

–With assistance from Ignacio Gonzalez, Reina Sasaki, Harshita Swaminathan, Sagarika Jaisinghani, Justina T. Lee and Maggie Shiltagh.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.