(Bloomberg) — A key measure of New York City’s fiscal health is deteriorating, adding to the largest US city’s financial worries in the face of billions of dollars in possible cuts from President Donald Trump’s administration.

Most Read from Bloomberg

The city’s Independent Budget Office projects New York’s operating surplus as a percentage of tax revenue will fall to 4.8% at the end of the current June 30 fiscal year, the lowest percentage since fiscal 2014.

IBO is projecting the city will finish fiscal 2025 with a $3.8 billion surplus, down from $6.1 billion in 2022, according to a Feb. 27 analysis of Mayor Eric Adams’ preliminary $114.5 billion budget for 2026.

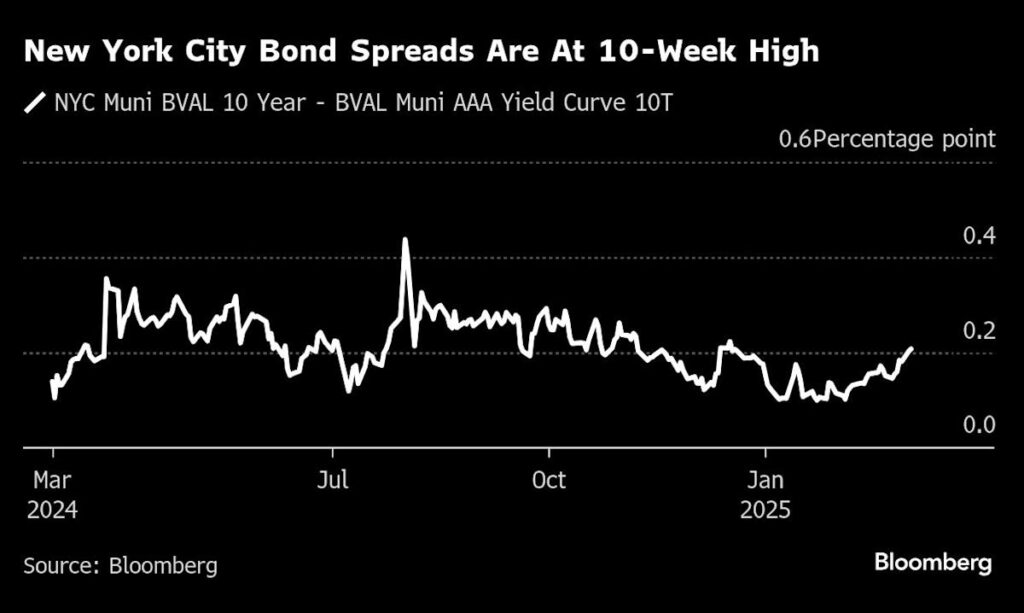

Mounting financial worries have helped drive up borrowing costs on the city’s debt. The spread on New York City general obligation bonds maturing in 10 years rose to 20 basis points on Monday, the highest since Dec. 19, according to data compiled by Bloomberg. The city plans to sell $1.4 billion of general obligation bonds on Wednesday.

While IBO’s surplus projection is larger than the city’s $2.3 billion estimate, the city continues to rely on risky financial maneuvers to balance its books, the budget monitor said.

Underestimated program costs, excessive overtime spending, and imprudent budgeting, combined with potential federal funding cuts and economic uncertainty, “put the City’s ability to weather near-term shocks and maintain long-term fiscal stability at risk,” said IBO director Louisa Chafee in an email.

New York City’s declining surplus comes as Trump and a Republican-controlled Congress are planning major cuts in health coverage for the poor, food stamps and rental assistance. The House of Representatives last week approved a budget resolution that calls for $4.5 trillion in tax cuts, partially offset by $2 trillion in spending cuts.

New York City receives almost $10 billion in direct federal aid for its $115 billion operating budget, according to the city comptroller. Overall, more than $100 billion in federal funding flows to New York City annually when considering major programs like Social Security, Medicare, and Medicaid.

New York City typically uses its surplus to prepay expenses for the following fiscal year and adds funds for spending on overtime for police officers and firefighters, as well as housing vouchers. But the cushion is shrinking. The city’s surplus has declined every years since fiscal 2022, according to the IBO.

Story Continues