HP Inc. (HPQ) is wasting no time preparing for the impact of President Trump’s tariffs on its business this year.

The computer and printer giant said Thursday evening that its full-year profit outlook now reflects the added cost of US tariff increases on China. HP didn’t slash its guidance because it found new cost savings to help offset the higher expenses.

HP added that by the end of its current fiscal year, more than 90% of its products sold in North America will be built outside of China.

At close: February 27 at 4:00:02 PM EST

HPQ ^GSPC

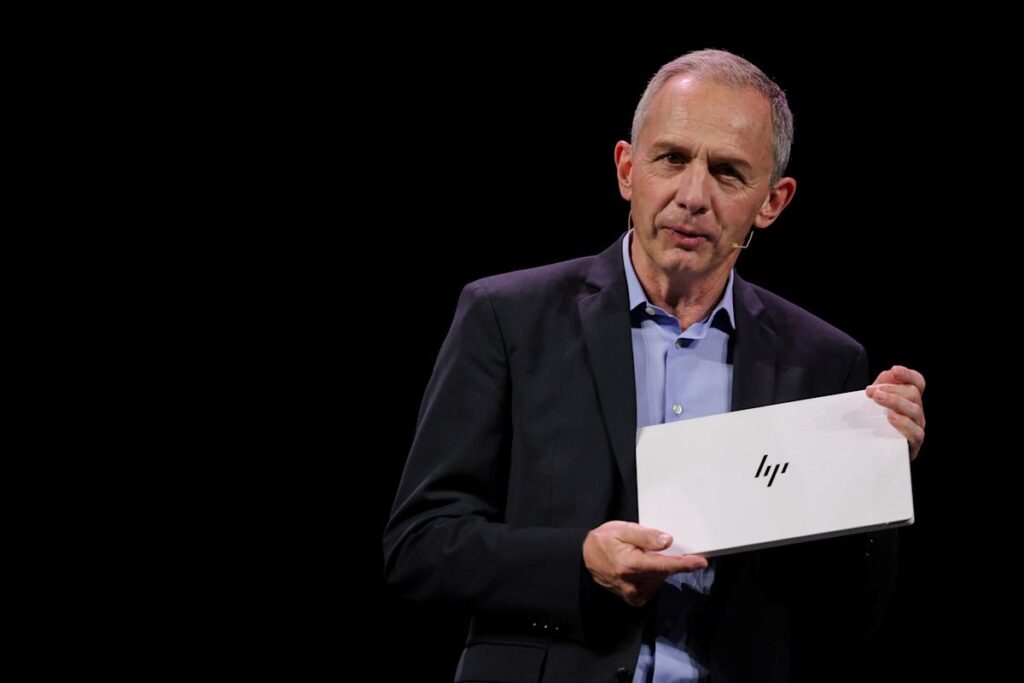

HP CEO Enrique Lores said that price increases on products are a last resort, but some targeted increases are assumed.

The company also plans to lay off up to 2,000 more employees, bringing total job cuts under its restructuring to as many as 9,000.

On Thursday, the computer and printer maker said it aims to save an additional $300 million by the end of fiscal 2025, which ends in October. It expects to incur about $150 million in restructuring and other charges, primarily from cash labor costs.

Shares of HP fell slightly in pre-market trading on Friday.

Indeed, all eyes are on artificial intelligence PC demand and tariffs for HP in 2025.

President Trump said Wednesday he will proceed with an additional 10% tariff on Chinese goods starting March 4, doubling the existing 10% across-the-board tariff that went into effect on Feb. 10. These tariffs will be added to the 10% to 25% duties that Trump imposed on more than $300 billion of products from China in his first term as president, which mostly remain intact.

Trump added that the 25% tariffs on imports from Mexico and Canada that have been paused since Feb. 3 would also kick in on March 4.

Read more: What are tariffs, and how do they affect you?

The Consumer Technology Association recently estimated that proposed tariffs from the Trump administration could increase laptop and tablet prices by as much as 46%. Smartphones could see a 26% price increase.

Taiwan-based PC maker Acer said earlier this month it would increase prices on products to the US by 10% due to the tariffs.

HP sells its products in China and relies on the country for key component sourcing. If higher tariffs go into effect, it could raise material costs and force HP to raise consumer prices.

«We anticipate that the bigger driver of the share price will be the investor sentiment around the likelihood of a PC recovery materializing in 2025, particularly driven by first quarter results as well as managements’ confidence in the pace of the refresh starting the year,» JPMorgan analyst Samik Chatterjee wrote in a client note.

Story Continues