(Bloomberg) — China needs to tackle its steel glut by cutting 15% of capacity this year, if mills are to meet their 2025 climate goals and return to profitability, according to clean energy analysts.

Most Read from Bloomberg

To get back on track, the country’s annual blast furnace capacity has to shrink by at least 200 million tons from its 2020 base — the equivalent of the whole of the European Union’s steel industry, the Centre for Research on Energy and Clean Air said in a report on Wednesday. Another 150 million tons needs to be zeroed out by the end of the decade.

The government has tried to guide production lower by tying output to emissions. But the country’s still pumping out too much steel, which in 2024 topped 1 billion tons for the fifth year in a row. The sector accounts for about 17% of China’s total emissions, according to CREA, and is still too heavily reliant on coal.

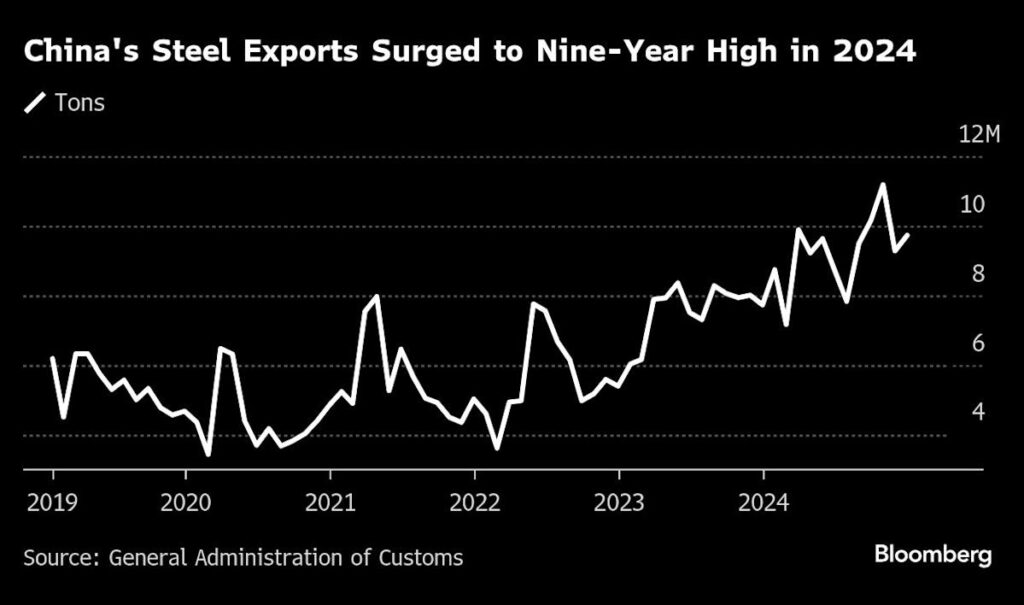

Steelmakers have suffered from a collapse in earnings and the industry lost money for most of last year. But overcapacity isn’t just an issue for China. Its steel exports have fanned global trade tensions after surging to a nine-year high in 2024.

The climate and capacity problems can be fixed by dramatically cutting down on highly polluting blast furnaces, and speeding up the adoption of low-carbon technologies such as electric arc furnaces and green hydrogen, CREA said.

China’s EAF steelmaking accounts for less than 10% of output, below the government’s target of 15% for 2025.

On the Wire

A lack of recent multibillion dollar deals made the race for a role on CATL’s Hong Kong listing even more competitive, despite low fees for bankers and a US blacklisting hanging over the world’s biggest battery maker.

Shipbuilding and maritime trade are emerging as new fronts in the US-China trade war, and unlike President Donald Trump’s call for blanket tariffs, his shipping crackdown seems to have support across the political spectrum in Washington.

India is finalizing a $1 billion capital subsidy plan to bolster its solar manufacturing industry, according to people with knowledge of the matter, as part of a wider effort to reduce dependence on China and profit from the global energy transition.

Some copper smelters in China are planning to ship their products abroad, and taking profits from higher global prices, according to people with knowledge of the matter.

Story Continues