(Bloomberg) — Subdued oil traders will be looking for clues at a major energy conference in London this week. Gold continues to pour into the US as the market provides arbitrage opportunities. And the price of liquefied natural gas in Europe is showing signs of easing as supply concerns take a step back.

Most Read from Bloomberg

Here are five notable charts to consider in global commodity markets as the week gets underway.

Oil

Oil traders will be meeting in London for International Energy Week against a backdrop of an oddly subdued market. The blitz of US President Donald Trump’s policy changes and trade measures as well as uncertainty surrounding the conflicts in Ukraine and the Middle East has locked crude futures into a narrow range this month and recently a measure of volatility to the lowest since July. Industry leaders will likely be discussing an upcoming OPEC+ decision on whether to bring back production as well as any other catalysts that could break the market out of its torpor.

Energy Industry

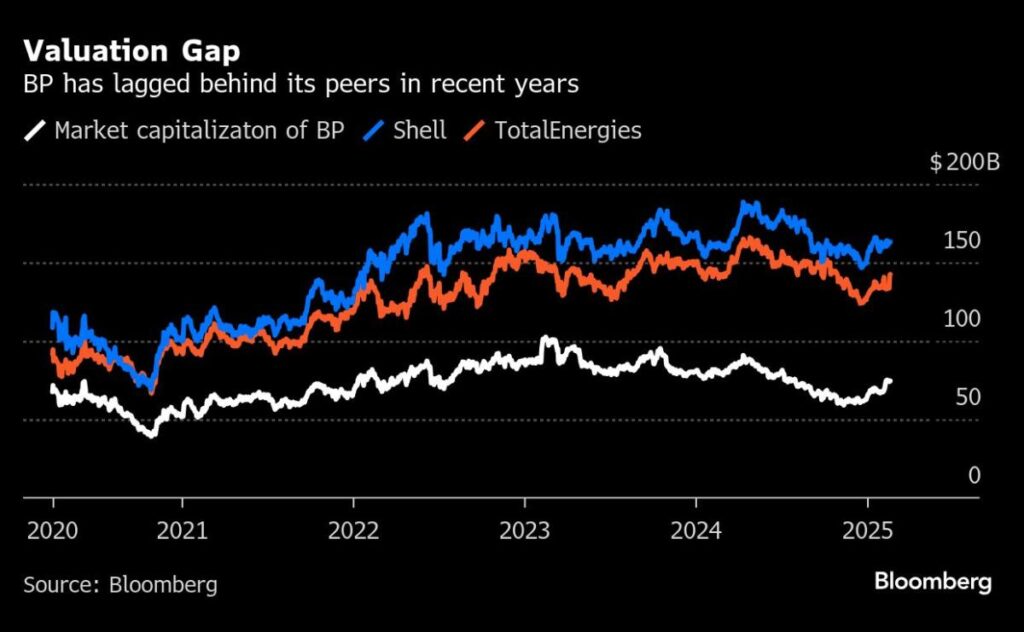

BP Plc is in the crosshairs of the world’s most famous activist investor, Elliott Investment Management. It has built a large stake in the struggling oil firm and is demanding transformative changes, including major cost cuts, asset sales and an exit from renewable power. After months of waiting, investors are expected to hear from Chief Executive Officer Murray Auchincloss Wednesday. He is set to reveal a new strategy he promised will “fundamentally reset” the company.

Corn

The US Department of Agriculture’s annual outlook forum will deliver the first widely watched acreage estimate for American crops including corn, soybeans, wheat and cotton. Farm lender CoBank sees corn acres spiking to the highest in five years. Corn is the top crop in the US, which is the world’s biggest producer and exporter of the grain.

Gold

US prices of bullion have surged above their international benchmarks in recent months amid fears gold may be included in Trump’s sweeping tariff measures. While many market participants don’t expect levies to be imposed on the precious metal given its monetary status, the huge price differential is fueling a rush among dealers, traders and investors to send gold to the US to capture the premium. That has led to a spike in bullion inventory at Comex warehouses, with stockpiles up by more than 20 million ounces since the US election.

Story Continues