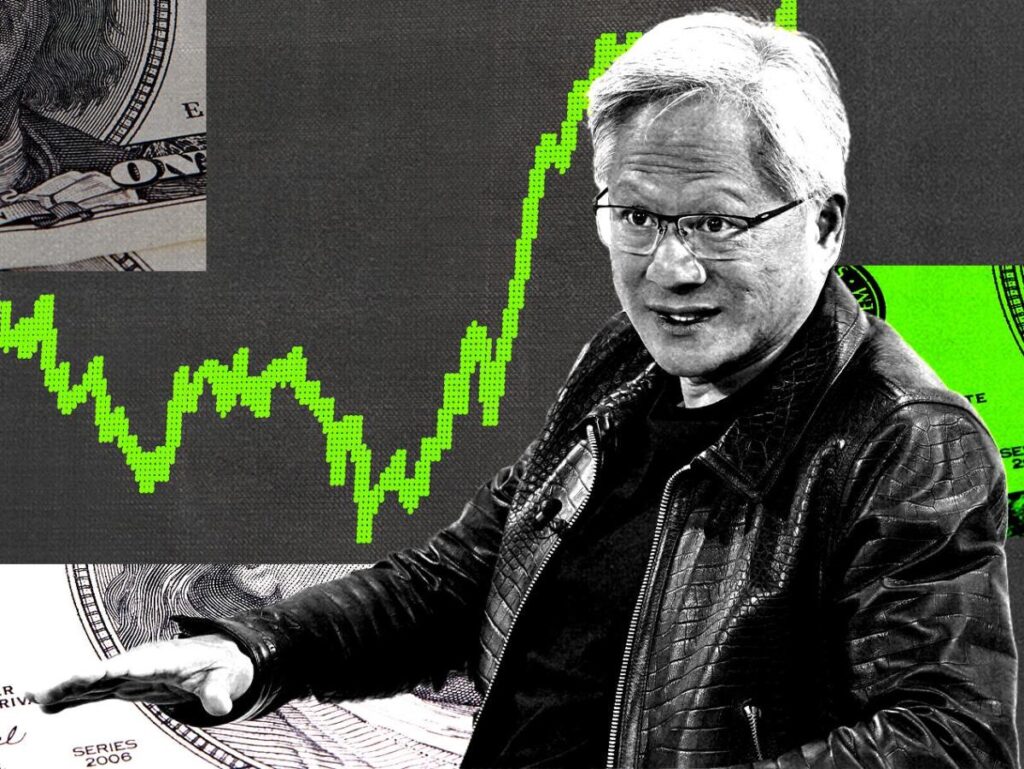

Nvidia stock has recovered its losses from the DeepSeek decline.

A 22% rally in February has boosted Nvidia shares above their 200-day and 50-day moving averages.

Investors are awaiting Nvidia’s earnings results next week, with updates expected on the next-gen Blackwell GPU.

Nvidia stock cleared a key hurdle on Tuesday as it recovered the losses sparked by the $589 billion DeepSeek sell-off in late January.

At its intraday high of $143.44, Nvidia was trading above its January 24 close of $142.62, the trading session before the GPU maker experienced the biggest one-day market value decline in history.

The stock has since pared its gains on Tuesday to about 1%, trading at $140.34.

Nvidia shares have been on a tear so far in February, rising about 22%. The rally has boosted the stock above several closely watched technical trading levels, including its 200-day and 50-day moving averages, as represented by the red and blue lines in the chart below.

David Keller, Chief Strategist at Sierra Alpha Research, recently told Business Insider that he was watching $130 as a key line in the sand for Nvidia shares, another hurdle it recently cleared.

The head of technical research at Oppenheimer & Co., Ari Wald, told BI that $140 is the key resistance level to monitor.

With the DeepSeek losses mostly recovered and the technical resistance levels cleared, investors are eagerly anticipating Nvidia’s earnings results next week.

«The next important test for AI bulls comes on Feb-26 when NVDA reports FQ4 results,» Bank of America analyst Vivek Arya said in a Tuesday note.

Arya warned that Nvidia’s stock price could be volatile after the earnings results, likely due to a potentially subdued first-quarter outlook driven by the transition to Blackwell GPUs. However, the long-term fundamentals should remain intact.

«We expect positive momentum to resume as investors look forward to NVDA’s leading new product pipeline (GB300, Rubin) and TAM expansion into robotics and quantum technologies at upcoming GTC conference (Mar-17),» Arya said.

Even after Nvidia’s 20%+ rally this month, Arya argued that the stock’s valuation remains «compelling» with a 24x price-to-earnings ratio based on 2026 estimates. That’s at the lower end of its historical range of 25x to 56x, according to the bank.

For its part, Super Micro Computer, which sells server racks integrated with Nvidia’s GPUs, said on its earnings call last week that it expects to see an inflection in its revenue thanks to the rollout of Blackwell.

Story Continues