(Bloomberg) — Trade wars and supply woes are pushing a basket of commodities to the highest levels in more than two years. Copper markets are having a reaction to threats of tariffs. And South American dryness has curbed the outlook for the world’s corn stockpiles.

Most Read from Bloomberg

Here are five notable charts to consider in global commodity markets as the week gets underway.

Commodities

Brewing global trade conflicts are rekindling price pressures and upending supply chains, pushing the price of a key commodity gauge to a two-year high. The Bloomberg Commodity Spot Index — a basket of raw materials spanning metals, energy and agriculture — has rallied nearly 8% this year to reach its highest level since December 2022.

Copper

Global copper markets have been witnessing extreme dislocations as the potential for tariffs on the key industrial metal drove a record gap between US and global prices last week. US President Donald Trump has threatened to slap tariffs on copper, though he hasn’t said at what rate or when they might start. Still, prospects of trade restrictions are spurring hectic trading with copper futures on New York’s Comex spiking to a record premium Friday over those on the London Metal Exchange, with the LME experiencing a dramatic short squeeze.

Oil

Russia’s crude flows have been a key focus for the oil market recently, and negotiations over sanctions and the war in Ukraine may help drive prices in the weeks ahead. Brent’s prompt spread — which widens when near-term supplies are expected to be scarce and narrows when they’re ample — surged last month as buyers sought replacements for Russian oil after tough new restrictions from the outgoing Biden administration. The measure has since eased thanks to surging replacement supplies and the potential for Ukraine peace talks.

Agriculture

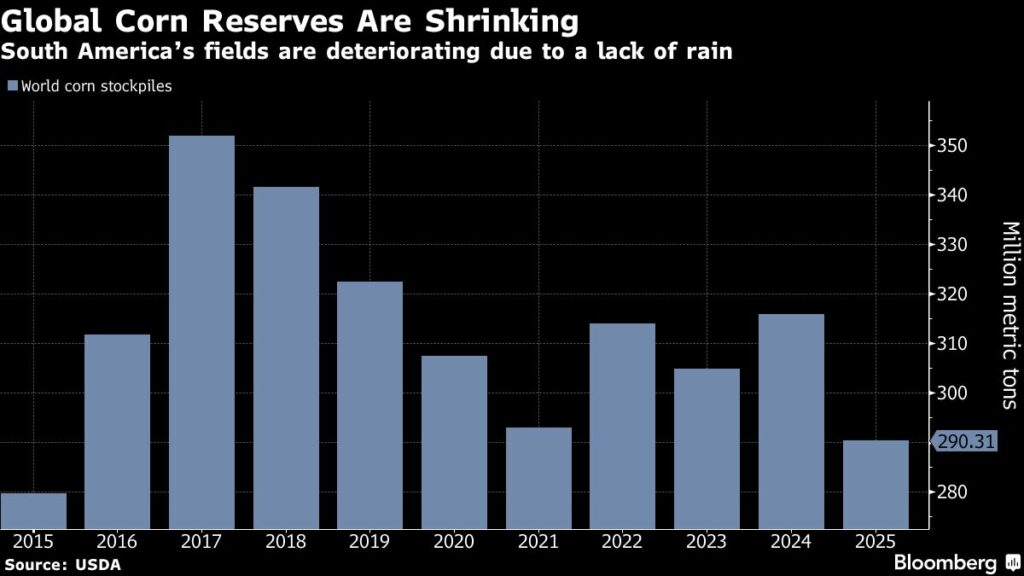

Persistent dryness in Argentina and parts of Brazil has forced the US Department of Agriculture to lower its outlook for global corn stockpiles when food inflation has stayed resilient. The agency sees reserves at 290.3 million metric tons, a four-year low, and benchmark futures are trading near the highest levels since August 2023 in Chicago. “Heat and dryness during January and into early February reduce yield prospects for early-planted corn in key central growing areas,” the USDA said of Argentina.

Story Continues