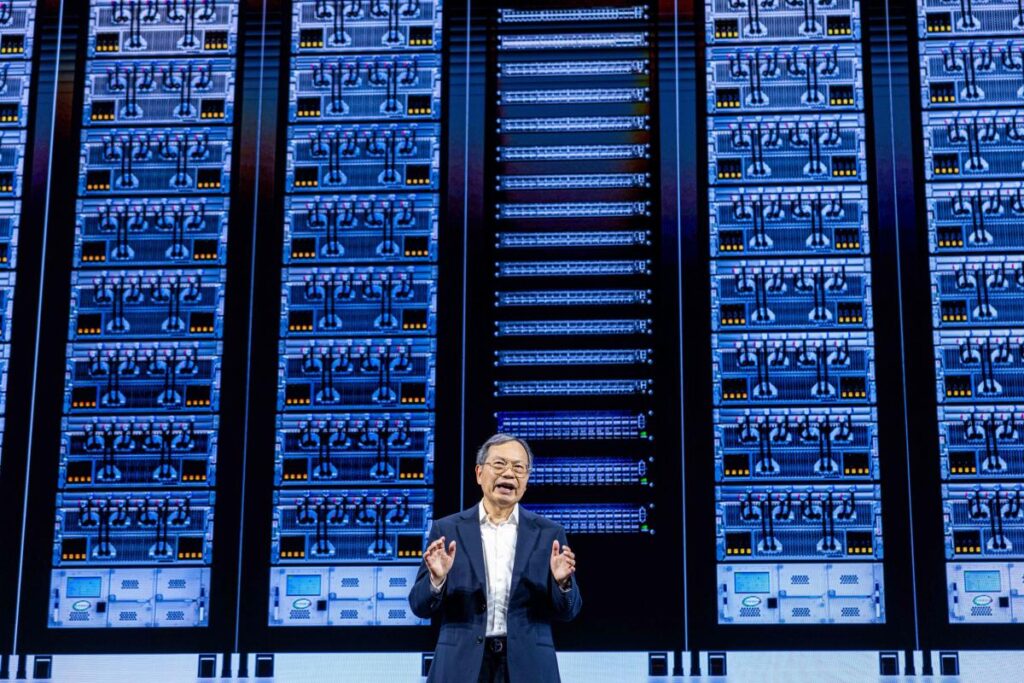

Bloomberg / Getty Images

Supermicro CEO Charles Liang speaks at the Computex conference in Taipei on June 5, 2024

Supermicro shares jumped Wednesday, a day after the company offered a strong sales outlook for 2026 and said it expects to submit its delayed regulatory filings in time to avoid delisting.

Several analysts raised their price targets for the stock, but cautioned it could be too soon to underwrite the company’s growth targets.

Supermicro said it expects to file its delinquent financial reports by the Nasdaq’s Feb. 25 deadline, which analysts said should ease delisting worries.

Super Micro Computer (SMCI) shares surged Wednesday, a day after the company offered a strong sales outlook for 2026 on anticipated demand for AI servers and said it expects to submit its delayed regulatory filings in time to avoid delisting.

The server maker on Tuesday lowered its revenue estimate for 2025 to between $23.5 billion to $25 billion, but called for revenue to grow more than 60% year-over-year to $40 billion in 2026 as demand grows for infrastructure to support AI.

That 2026 outlook “presents a nice upside surprise,” JPMorgan analysts said, though they added it could be too early to underwrite such an «aggressive» target. The analysts maintained an “underweight” rating for the stock, but raised their price target to $35 from $23.

Wedbush analysts, who said they are «hesitant to model as aggressively as management’s forecast,» suggested they anticipate 44% year-over-year growth in fiscal 2026, which would mean revenue of $34.77 billion. Wedbush raised its price target for Supermicro stock to $40 from $24 while maintaining a “neutral» rating.

Supermicro also said it expects to submit its delayed financial reports from the 2024 fiscal year by the Nasdaq’s Feb. 25 deadline to avoid being delisted. JPMorgan attributed its price target increase in part to Supermicro’s “increased conviction” that it will meet the deadline, while Wedbush said the company getting its reports filed “should reduce uncertainty.”

The company’s delinquent reports have raised worries it could be delisted, amid concerns about the company’s accounting practices. Supermicro formed an independent special committee, which said in December that its probe of the company, «did not raise any substantial concerns about the integrity of Supermicro’s senior management.”

Supermicro shares jumped over 6% intraday Wednesday to $40.98, though even with Wednesday’s gains, they’ve lost over half their value in the past year.

Read the original article on Investopedia