(Bloomberg) — Asian equities advanced Thursday after stocks and bonds rose on Wall Street in a week marred by tariffs, lackluster tech earnings and uneven US economic data. The yen strengthened to the highest level since early December.

Most Read from Bloomberg

A gauge of Asian equities rose for a third day to the highest level since Dec. 18. US equity futures were steady after the S&P 500 and Nasdaq 100 both notched a second day of gains on Wednesday. Shares gained in Hong Kong and mainland China, reversing Wednesday’s losses. Treasuries were steady after a sharp rally overnight. A gauge of dollar strength was little changed after two days of decline.

Thursday’s relatively stable trades contrast with the volatility in the market since Monday after President Donald Trump decided to impose and then defer tariffs on Canada and Mexico. The US went ahead with a 10% tariff on all imports from China, which immediately retaliated by with some levies on US.

“Asian markets are taking a break from the previous uncertainties over US-China tariffs,” said Gary Ng, a senior economist at Natixis SA. “However, the Trump factor will continue to be a key source of volatility, and the potential for US-China relations will continue to drive investment flows,” he said.

The yen trimmed some of its gains against the dollar. Bank of Japan’s most hawkish board member Naoki Tamura said interest rates could touch 1% in the second half of the fiscal year 2025. The Japanese currency also faces fresh demand from hedge funds amid volatile trading in currency markets.

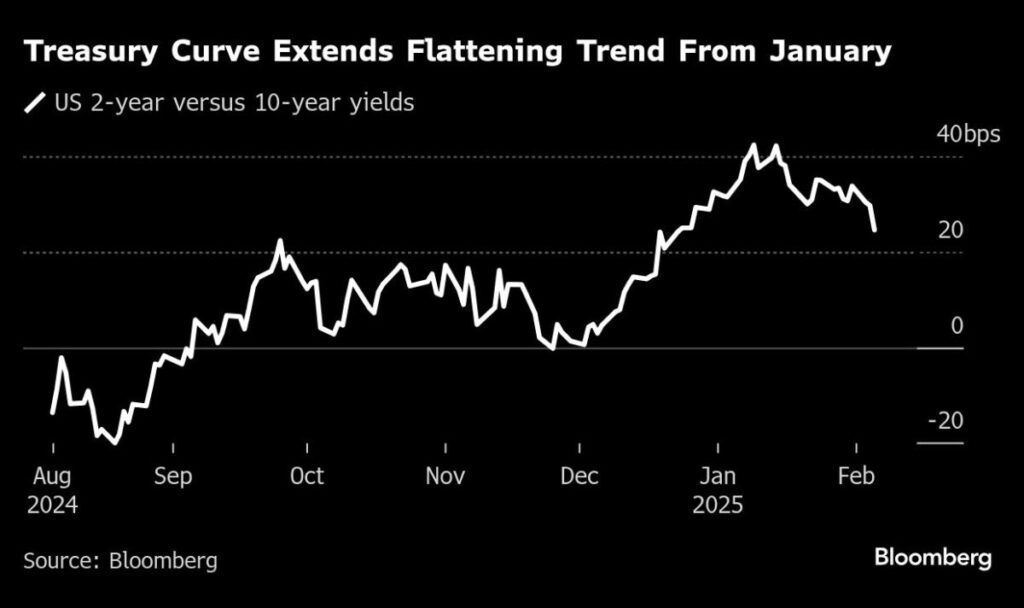

Treasuries were steady in Asian trading after rallying across the curve Wednesday. The US 10-year yield dropped nine basis points to 4.42% during the session while the policy-sensitive two-year yield declined three basis points to 4.18% — both the lowest since the middle of December.

Meanwhile, Treasury Secretary Scott Bessent said the Trump administration’s focus with regard to bringing down borrowing costs is 10-year Treasury yields, rather than the Federal Reserve’s benchmark short-term interest rate.

Elsewhere in Asia, Vietnam’s inflation quickened at its fastest pace in six months and Singapore said it will announce stock market measures soon.

In Europe, the Bank of England is expected to reduce interest rates by 25 basis points to 4.5%.

Story Continues