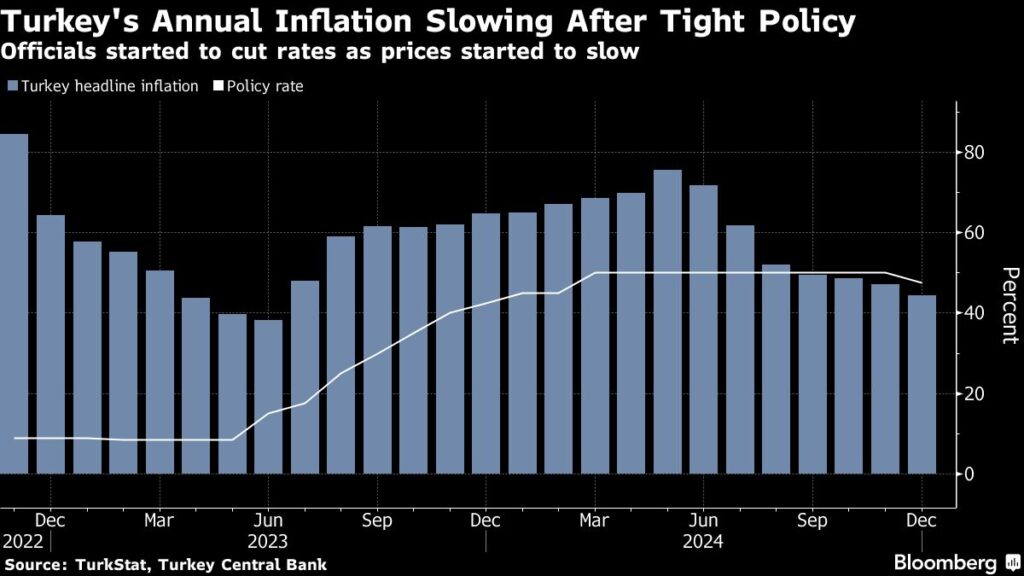

(Bloomberg) — Turkey’s annual inflation probably eased to 41.2% at the start of the year, giving policymakers reassurance as they push forward with interest-rate cuts.

Most Read from Bloomberg

Annual growth in consumer prices is projected to slow in January from a 44.4% reading the month before, according to the median forecast in a Bloomberg survey of analysts. The data is scheduled to be released on Monday at 10 a.m. local time.

The central bank lowered borrowing costs in January for the second straight month and signaled similar moves will follow. The one-week repo rate dropped 250 basis points to 45%.

Officials dropped a reference to “monthly” inflation — their preferred gauge until then — suggesting an easing bias. Market implied policy rates project another 5 percentage points being shaved off over the next three months, likely to be evenly split between the next two meetings in March and April.

Monthly inflation is set to jump to 4.4% in January from 1% at the end of last year, according to a separate Bloomberg poll.

What Bloomberg Economics Says…

“We expect annual inflation to follow a general trajectory lower, reaching 25% by end-2025 and 14% by end-2026. Those rates still remain elevated relative to the central bank’s 5% target, but also reflect a vast improvement on the 75.5% peak seen last year. We view this outlook as supportive of a gradual easing in financial conditions. In this regard, we expect the central bank to cut its policy rate to 25% by year-end, down from the current 45%.”

— Selva Bahar Baziki, economist. Click here to read more.

Slowing inflation and policy easing have started to lure investors to Turkey’s bond market. Five-year and 10-year yields declined the most since May 2023 this month.

Central Bank Governor Fatih Karahan is due to announce this year’s first quarterly inflation report on Feb. 7. The bank’s most recent projection sees consumer prices slowing to 21% at the end of the year.

–With assistance from Inci Ozbek and Joel Rinneby.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.