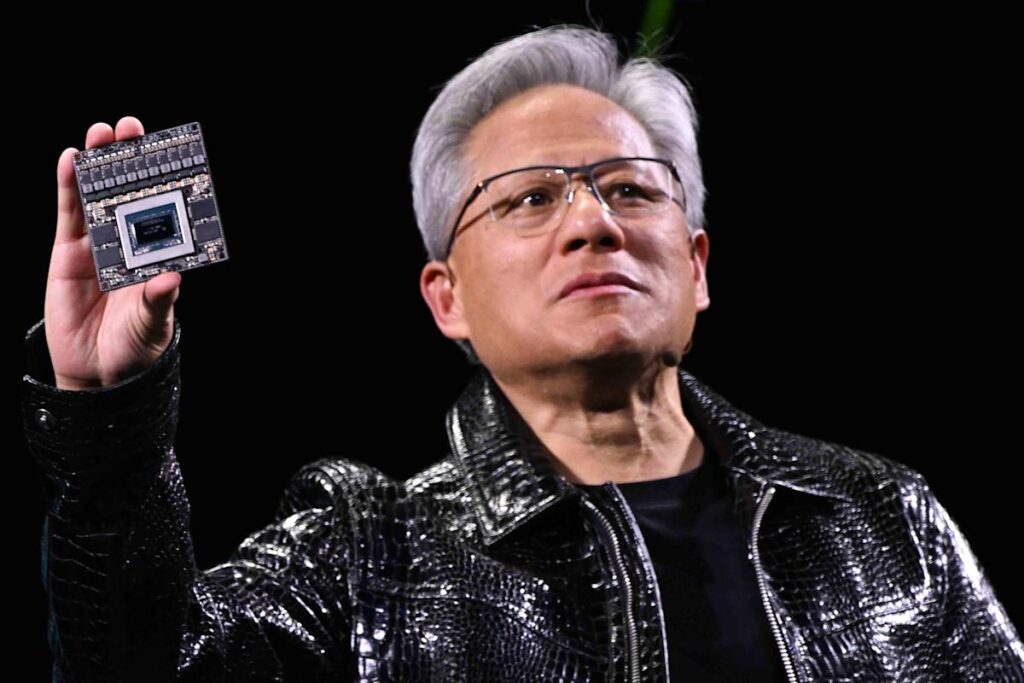

NurPhoto / Contributor / Getty Images

Nvidia CEO Jensen Huang during the keynote presentation at CES 2025 in Las Vegas, Nevada, on Jan. 6, 2025

This week’s post-earnings losses brought Nvidia’s stock near the January lows that came after a DeepSeek-driven plunge.

Analysts have largely remained bullish, pointing to Nvidia’s strong outlook on the back of growing AI demand.

Several also said they expect Nvidia to benefit from DeepSeek’s emergence and growing competition.

Nvidia’s (NVDA) stock has had a tough start to 2025, with this week’s post-earnings plunge dragging shares back near the January lows that came after a DeepSeek-driven selloff.

Its shares edged higher Friday as the stock found some support after plunging over 8% Thursday, but that still left the stock roughly 7% lower for the week and year. Analysts have largely remained bullish, pointing to Nvidia’s strong outlook on the back of growing AI demand.

Their optimism comes as investors appear uncertain about the path ahead for the recently highflying stock, shares of which have added about half their value over the past 12 months. Chinese startup DeepSeek’s claims that its AI model could keep up with American rivals at a fraction of the cost and computing resources had raised worries demand for Nvidia’s most advanced chips could slow, but several analysts said they believe Nvidia stands to benefit from DeepSeek’s emergence and growing competition.

During Wednesday’s earnings call, CEO Jensen Huang said that demand for AI inference is accelerating as new AI models emerge, giving a shoutout to DeepSeek’s R1.

DeepSeek «has ignited global enthusiasm,” Huang said, adding that «nearly every AI developer» is applying R1 or adopting some of DeepSeek’s innovations into their own technology. Rather than diminishing the need for advanced chips, Huang said, next-generation AI will likely require significantly more computing power as applications become more sophisticated, leaving Nvidia poised for growth.

Citi and JPMorgan analysts said following the call that they were reassured by Huang’s comments around DeepSeek and the expected trajectory of computing needs. Wedbush analysts said they believe Nvidia will ultimately end up a «DeepSeek beneficiary.»

Analysts at Bank of America suggested competition from China could also push American firms to act with greater urgency on AI developments, rather than scale back spending. In recent earnings calls, several of Nvidia’s Big Tech buyers, including Meta (META), Microsoft (MSFT), Amazon (AMZN) and Google parent Alphabet (GOOGL), did exactly that—announcing plans to raise their capital expenditures to fuel AI ambitions.

Read the original article on Investopedia