(Bloomberg) — Follow Bloomberg India on WhatsApp for exclusive content and analysis on what billionaires, businesses and markets are doing. Sign up here.

Most Read from Bloomberg

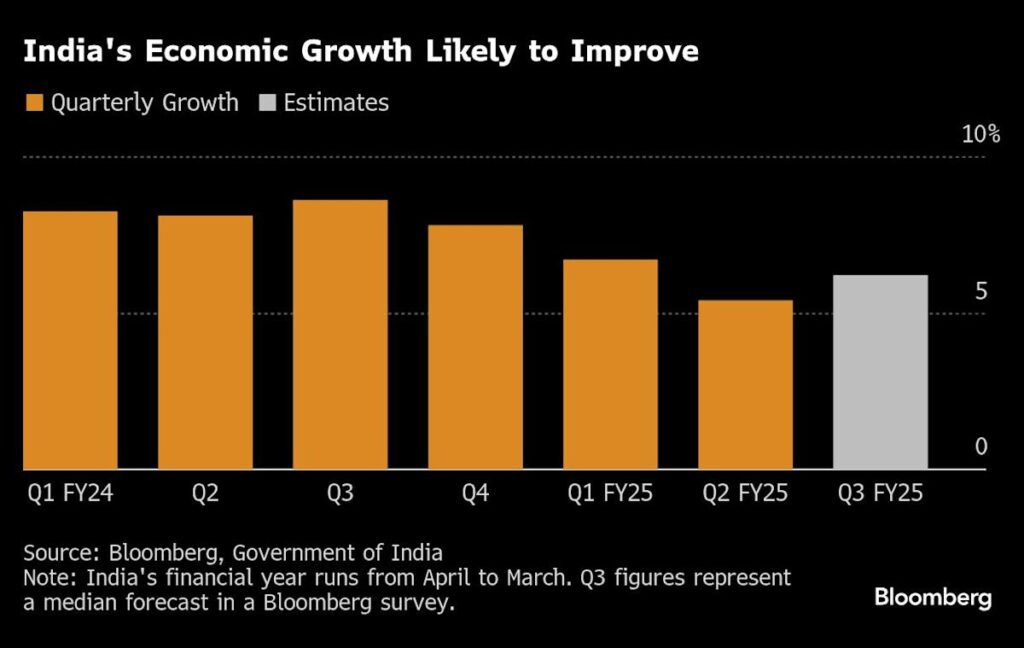

India’s economy rebounded last quarter, offering some relief to Prime Minister Narendra Modi whose ambitious growth plans have come under pressure due to recent slowdown.

Gross domestic product grew 6.2% in the three months to December, the Statistics Ministry said in a statement on Friday. That figure was in line with the median forecast in a Bloomberg survey of economists, and much higher than a revised reading of 5.6% expansion in the July-September period.

For the full year, India’s economy is forecast to grow at 6.5%, an upward revision from previous projection, the ministry said. The government expects growth rate to be below 7% in the next financial year as well.

The 10-year benchmark bond yield edged higher after the GDP numbers were published. Local stocks and the rupee closed lower ahead of the data release.

A pick-up in government spending after national polls and strong rural consumption helped bolster growth in the last quarter. Government final consumption expenditure grew 8.3% in the three months to December from a year ago, compared to 3.8% in the previous quarter. Private consumption also improved during the three-month long festive season, with agriculture sector benefiting from surplus rains and a bumper harvest.

While India is still the fastest-expanding major economy, growth is well below the 8% pace required for Modi to fulfill his bold pledge of converting the country into a developed nation by 2047. The growth prospects for the next year remain uncertain as US President Donald Trump threatens to upend global trade with tariffs.

Exports and a rebound in government and private spending will support growth in the last quarter of the financial year, India’s Chief Economic Adviser V Anantha Nageswaran told reporters in a virtual briefing, adding the country’s economic momentum is expected to sustain.

Analysts are not that optimistic. Even though the GDP print broadly came in line with expectations, the implied growth estimate of around 7.5% for the January- March period looks “significantly optimistic,” said Upasna Bhardwaj, an economist at Kotak Mahindra Bank Ltd. in Mumbai. She expects this fiscal year’s GDP figure to be lower than the government’s estimate by around 20-30 basis point.

Story Continues